posted by Spencer Parkinson on Wednesday, June 22, 2016

In an earlier post, I provided readers some background on who I am, where I grew up, and how a Mountain West farm kid made his way to the Midwest. As I wrote previously, I had the pleasure of working with the Gittins family on their diversified dairy farm in Smithfield, UT during my middle school, high school, and college years. The experiences I had there have in many respects guided my direction since.

Before words like wearables, mobile apps, and big data were commonplace in agriculture, working on a dairy farm taught me that it was indeed possible to merge my interests of analytics and agriculture. Fast forward to my time here in Iowa and I continue to thoroughly enjoy making the connection between numbers, data, and well-informed decision-making. I also continue to be keenly interested in how my dairy friends are doing.

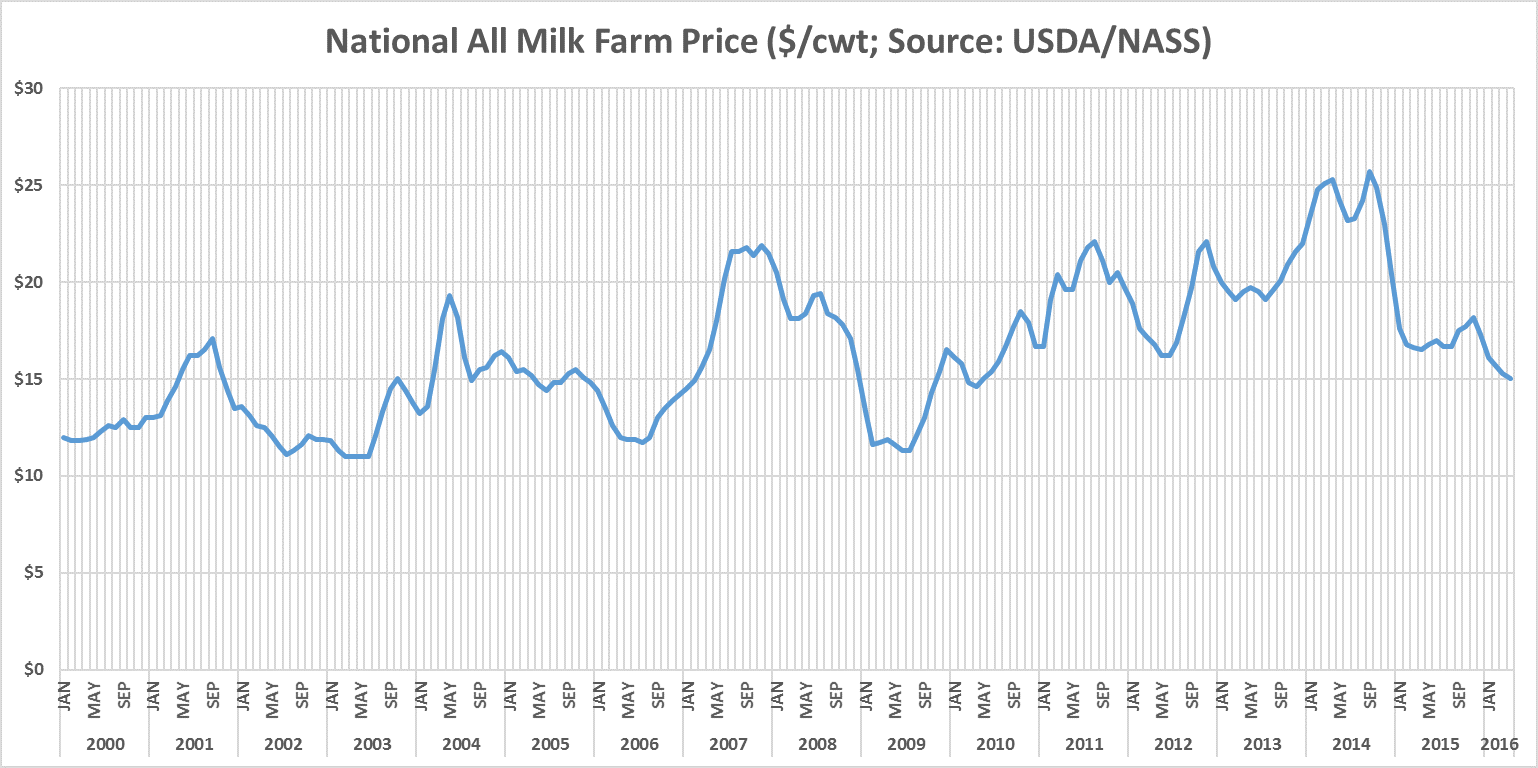

Dairy farmers are very aware of the fall in milk prices over the last 12-18 months. The chart below shows the average national price of milk received by dairy farmers since 2000. At over $25/cwt for brief periods of time, milk prices in 2014 were the highest they’ve ever been (even higher than they were in 2007-08). Shortly after 2014 began to come to a close, however, milk prices fell by 40% to where they are today ($15/cwt).

What caused this large drop in prices? Was it because people quit drinking milk? Did dairy cows produce too much milk? What I learned in my basic economics classes suggest the answer is both. At the same time consumers were experiencing “sticker shock” and curtailing purchases, dairy farmers were taking advantage of what they knew would be a temporary season of high prices. But, as the old adage goes, the best cure for high prices is…high prices. Eventually higher milk production made for a large surplus, causing the fall in prices.

Now, dairy farmers find themselves in the position of production costs being higher than breakeven. During at least early 2015, this wasn’t such a challenge since dairy farmers had just come off of very high prices and feed prices had fallen to manageable levels. Unfortunately, hot and dry weather, plus a few other variables so far in 2016 have worsened this part of the profitability equation.

As in other industries experiencing tough economics, the period of time where profitability proves elusive is the time where dairy farmers get smarter and more effectively utilize the increasing number of tools at their disposal. The dairy industry is certainly not a newcomer to collecting and leveraging their data. They have been keeping detailed records since the early 1900s (think Dairy Herd Improvement Association). I vividly remember the “milk tester” coming on a regular basis to that farm I worked on in northern Utah. I’d usually think they were in the way, slowing me down from getting to my after-work plans.

As I later learned while working on the farm and have experienced since, that long history of data has a story to tell, which brings me back full circle to where we are today – us partnering with our clients so they have the very best chances of making business-sustaining decisions that preserve their life’s work for the next generation.

Visit our website to learn more about our Dairy Stochastic Analysis Tool (DSAT). The DSAT model is specifically designed to help dairy owners and managers better understand the production and financial challenges they consistently face.