posted on Tuesday, June 23, 2020

The U.S. is the largest producer of poultry meat and one of the largest producers of eggs in the world. The level of domestic consumption of poultry meat (turkey, broilers, and other chicken) is very high. Although the total poultry meat consumption is less than the total red meat consumption in the U.S., it is considerably higher than either pork or beef consumption individually.

Import tariffs

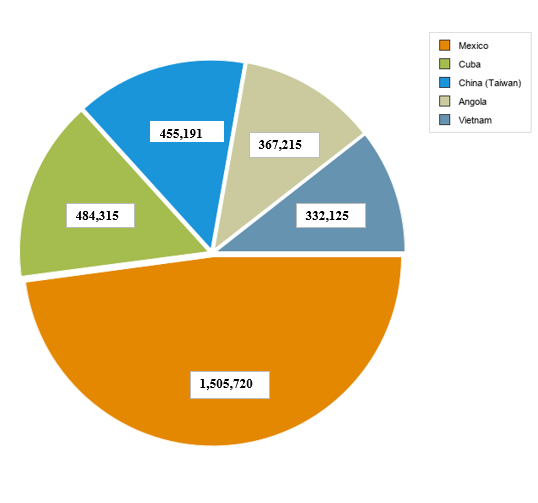

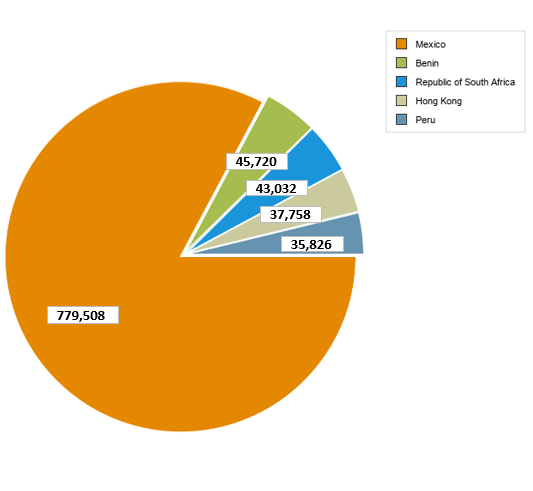

The U.S. is the largest exporter of turkey and the second-largest exporter of chicken in the world. Mexico is the largest importer of U.S. poultry meat (turkey and chicken individually) according to 2019 data. The top five importing countries of U.S. chicken and turkey are shown in Figure 1 and Figure 2, respectively. The U.S. poultry and egg industry exports poultry meat to 120 countries and eggs to 87 countries across the world. But the volume of poultry and egg exports are significantly dependent on the import tariff (at times retaliatory) and Most Favored Nation (MFN) tariff imposed by the partner countries. "An MFN tariff is the most reduced conceivable tariff a nation can impose on another nation. For instance, if a nation's least tariff is five percent of the value of a good, this is its MFN tariff, and it charges this rate on an import from a nation with most favored nation status."

Figure 1: Top 5 Export Markets for U.S. Chicken Meat, 2019 (1,000 pounds)

Source: USDA/Economic Research Service

Figure 2: Top 5 Export Markets for U.S. Turkey Meat, 2019 (1,000 pounds)

Source: USDA/Economic Research Service

Export trend of poultry meat and egg in the U.S.

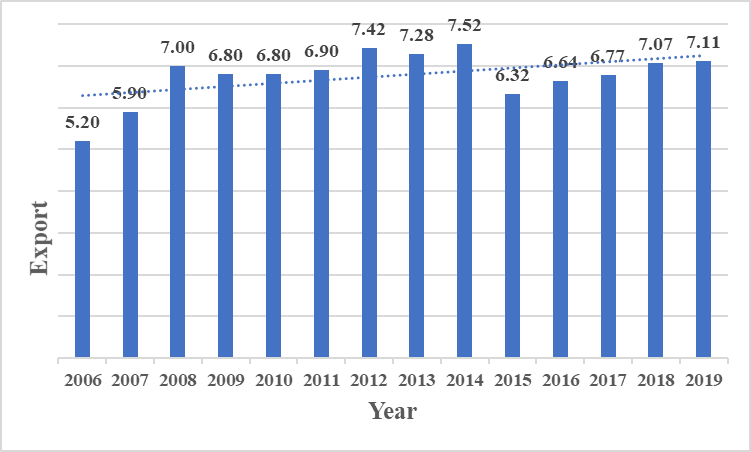

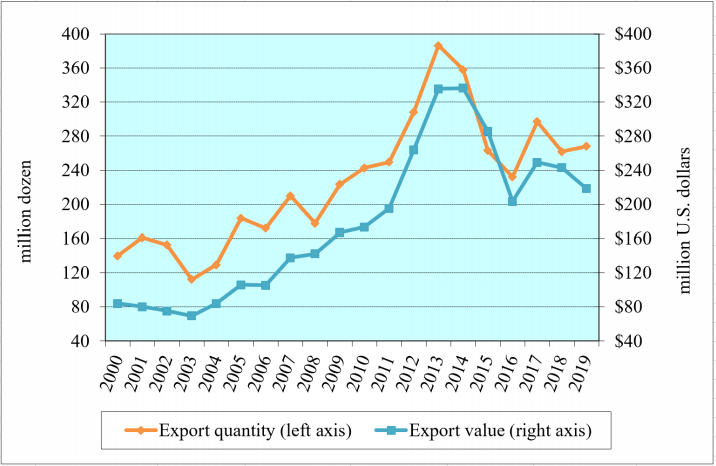

Figure 3 shows the volume of total broiler exports from the U.S. from 2006 to 2019. In 2019 total broiler exports were about 7.11 billion pounds, which is about 0.6 percent more than in 2018. The total value of exports in 2019 was about $3.18 billion, which is about 0.3 percent more than in 2018. About 3.59 billion pounds of (about 50.61% of total) broiler exports were shipped to the top six markets, including Mexico, Hong Kong, Cuba, Taiwan, Angola, and Vietnam. U.S. turkey exports have increased both volume and value in 2019 as reported in the trade data from USDA Foreign Agricultural Service. Turkey exports have increased by 4.6 percent in volume and 8.8 percent in value in 2019 compared to 2018. The egg export market has also experienced growth in volume but not in the value of exports in 2019. U.S. egg exports (table eggs plus egg products in shell egg equivalent) have increased by 2.4 percent in volume and decreased by 10.2 percent in value compared to 2018 (see Figure 4).

Figure 3: Broiler Exports (billions of pounds)

Source: USDA/Economic Research Service

By the dawn of 2020, the U.S. poultry and egg industry has witnessed a surge in export volumes and export values of poultry meats and eggs. Broiler exports have increased by 20.5% in value due to an increase in export prices. Exports of turkey have increased both by volume and value from 2019. The total volume of egg exports increased during the first quarter of 2020 due to a decrease in export prices (for both egg items and table eggs), according to the USDA’s Foreign Agricultural Service report, shown in Figure 4.

Figure 4: Export of Table Eggs and Egg Products (in Shell Equivalent) from the U.S.

Source: USDA/FAS/GATS Database

Retaliatory tariffs and trade agreements

Poultry meat export has increased since the beginning of 2020, as China has opened their market to U.S. exports after a long wait. On December 25, 2019, the General Administration of China Customs (GACC) updated its website to show the eligibility of an additional 177 U.S. cold storage facilities that had been submitted on November 27, 2019 by the USDA’s Food Safety and Inspection Service (FSIS) after USA Poultry and Egg Export Council (USAPEEC) had compiled the list.

Another reason for the surge in export of poultry products from the U.S. is the official signing of the U.S.-Japan Trade Agreement, which went into effect in April 2020 in the U.S. poultry and egg export industry through reduced tariffs and improved export opportunities. Through this agreement, Japan agrees to eliminate tariffs for turkey, egg, and duck products immediately. They also agreed to gradually reduce the other tariff rates every year on the 1st of April for the next 12 years. As a result, there will be a great opportunity for U.S. poultry producers to trade with Japan and stay competitive with members of the Trans-Pacific Partner countries in the world poultry export market.

A significant opportunity for poultry producers in the U.S. has opened with Canada since May 2019. Canada withdrew all the 232 retaliatory tariffs on U.S. imports in May 2019, which were put in place in July 2018. It had earlier included a 10% retaliatory tariff on prepared product categories under beef, poultry, dairy, fruit, vegetables, drinks, coffee and spices, chocolate and confectionary, and whiskey. Although Canada’s import of agricultural products from the U.S. had decreased from $2.4 billion in 2017 to $2.3 billion in 2018, that could be recovering since 2019, as reported in the Canadian customs data and by the CRS report.

An important discussion on trade negotiations regarding the U.S. poultry exports is currently taking place between the U.S. and the UK, post-Brexit. The inclusion of U.S. poultry products in any new trade agreement with the UK is being largely discussed. As mentioned in the report published by the Global Meat News, a new scope for negotiation with the UK has opened after the official Brexit on January 31, 2020. As part of the European Union since 1997, the UK adhered to the regulatory ban on the U.S. exported poultry due to standard antimicrobial washes used in the American poultry production. Nevertheless, the European food safety authority reports that the method of chlorine-washing poultry (used in the American poultry production) is scientific and there is no presence of the chemical in the final product, so it is safe for human consumption. Hence it is important to negotiate on the unscientific ban on poultry meat with the UK. Once the ban is lifted and the UK opens markets like Japan and China it will set a strong platform to renegotiate with the EU on the issue in the future.

Other poultry and egg export market opportunities

Given recent trends in the rising demands of poultry meat and egg exports from the U.S., exports are expected to rise more by the beginning of 2021. USAPEEC is also exploring the other potential export markets in the fast-growing economies of sub-Saharan Africa. USAPEEC has hosted 17 countries from sub-Saharan Africa for a three-day seminar recently in Pretoria, South Africa. The fast-growing economies that are identified to have an increased import demand of poultry meats and eggs from the U.S. over the last five years are Angola, Benin, Botswana, Congo, Democratic Republic of Congo, Gabon, Ghana, Guinea, Kenya, Mozambique, Namibia, Nigeria, Senegal, Seychelles, Sierra Leone, South Africa, and Tanzania. The U.S. also has potential to export more poultry products to other middle eastern countries such as Egypt, Kuwait, Saudi Arabia, and Lebanon that have an increasing demand for poultry meats and eggs from the U.S. The export market to many of those countries is mostly constrained with regulatory barriers and other tariff and non-tariff barriers which can be negotiated in any new trade agreement with the respective countries.