posted by S. Patricia Batres-Marquez on Wednesday, January 27, 2021

USDA’s January 14, 2021 forecast for U.S. corn exports during the 2020/21 marketing year was lowered by 100 million bushels from last month’s projection to 2.550 billion. The reduction in expected exports reflects lower beginning stocks and production (due to lower yield and a small reduction in harvested area) and higher corn prices. U.S. corn production was pegged at 14.182 billion bushels, down 325 million bushels from the December 2020 projection, while the average marketing year price was forecast up $0.20/bushel to $4.20.

Export Commitments

According to the latest corn trade data published by USDA on January 22, 2021, U.S. total corn accumulated exports to all countries through the first four-and-a-half months of the 2020/21 marketing year (20th week-January 14, 2021) was estimated at 693 million bushels (Figure 1). Accumulated exports by the 20th week of the current marketing year were about twice the accumulated corn exports by the same week of the previous year, but down 9% from those during the 2018/19 marketing year (see Figure 1).

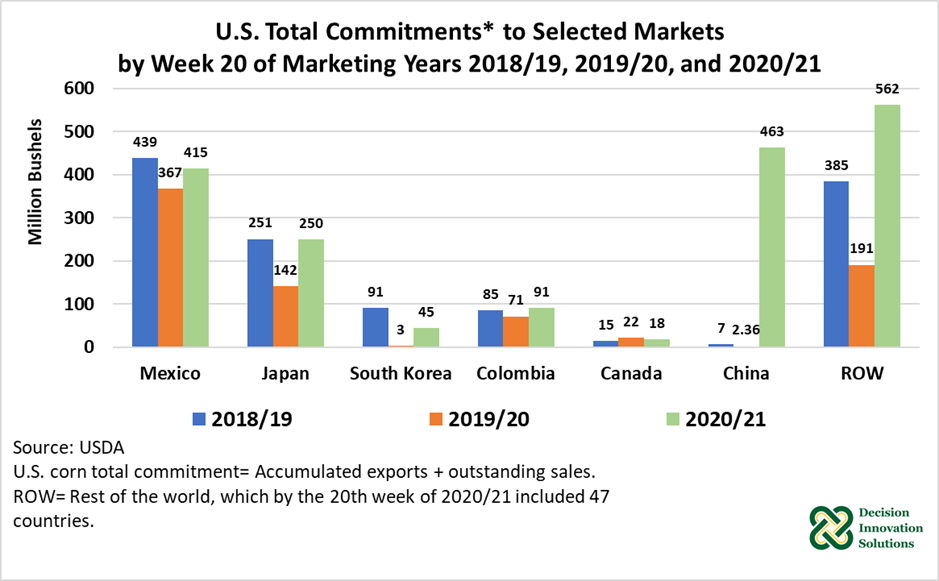

In addition, outstanding corn sales[1] by the 20th week of the 2020/21 marketing year reached a high volume of 1.150 billion bushels, which was up by 637 million bushels and 737 million bushels from the 2018/19 and 2019/20 marketing years, respectively. Overall, because of the large volume of outstanding sales as of the 20th week of current marketing year, total commitments (accumulated exports + outstanding sales) reached a record high volume of 1.843 billion bushels compared with the same period in the previous two years (1.271 billion bushels in 2018/19, and 799 million bushels in 2019/20).

%20(Week%2020).png)

Figure 1. U.S. Corn Export Commitments (All Countries) (Week 20)

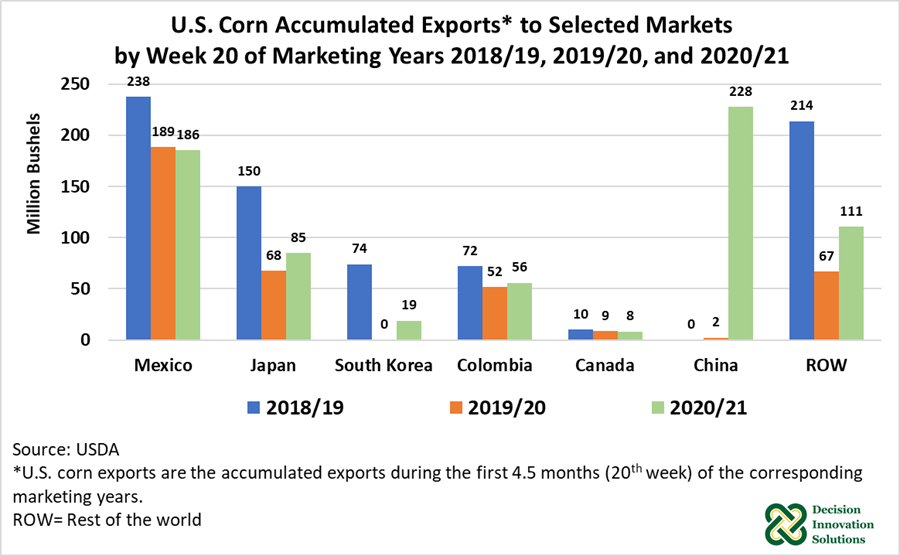

Accumulated Export to Selected Markets

Traditionally Mexico has been the top market for U.S. corn, but given the large volume of shipments to China during the first four-and-half months of the current marketing year (228 million bushels), China is currently the leading market for U.S. corn with a 33% share of total U.S. corn exports. In contrast, exports to China represented only 1% of total exports by the 20th week of the previous marketing year (Figure 2). China’s corn imports have grown this marketing year reflecting stronger feed demand and increasing domestic corn prices compared with world prices. Demand for feed has grown in part due to China’s recovering swine herd, which was severely impacted by African Swine Fever in recent years.

Accumulated exports to Mexico during the first 20 weeks of 2020/21 (186 million bushels) were slightly below the previous year (189 million bushels), but substantially down from 2018/19 (238 million bushels) (Figure 2). In addition, U.S. accumulated corn exports to Japan by the second week of January 2021 (85 million bushels) were up 26% up from the same time in 2020; however, exports to Japan were 43% below from 2018/19. U.S. corn exports to the rest of the world (ROW), which in 2020/21 represented 47 countries, was estimated at 111 million bushels, or 17% of total sales.

Figure 2. U.S. Corn Accumulated Exports to Selected Markets by Week 20 of Marketing Years 2018/19, 2019/20, and 2020/21

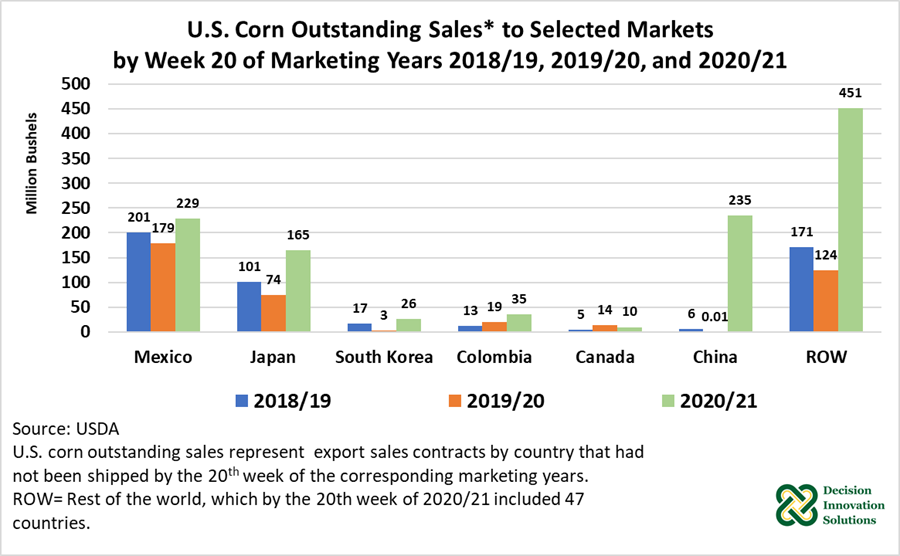

Outstanding Sales

As of the 20th week of the current marketing year, China’s share of total outstanding sales was 20.5% (235 million bushels), compared with 0.002% (8,267 bushels) by the 20th week of the last marketing year.

In addition, by January 14, 2021, outstanding sales to Mexico and Japan represented 19.9% and 14.3%, respectively. Outstanding sales to both Mexico and Japan by the 20th week of 2020/21 were up from the same time during the previous two years (see Figure 3). The latest data indicates outstanding sales to ROW represented 39.2% (451 million bushels) of the total pending shipments, in contrast with 30.1% last marketing year (124 million bushels). In addition, U.S. total corn commitments to selected markets are shown in Figure 4.

Figure 3. U.S. Corn Outstanding Sales to Selected Markets by Week 20 of Marketing Years 2018/19, 2019/20, and 2020/21

Figure 4. U.S. Total Commitments to Selected Markets by Week 20 of Marketing Years 2018/19, 2019/20, and 2020/21

A note about Mexico’s corn policy:

On December 31, 2020, Mexico published a final decree that requires a phase-out of use of both the herbicide glyphosate and genetically modified (GE) corn for human consumption in Mexico. According to the decree, the use of glyphosate will be phased out over the next four years and calls for the revocation of existing and future permits for GE corn cultivation and consumption. The Mexican government has yet to inform how it defines GE for human consumption and implications for corn-derived products, if any. Moreover, no details about the implementation of the decree and timelines for the changes have been offered yet.

Most of the U.S. corn exported to Mexico is yellow corn used for livestock feed and to a lesser degree U.S. yellow corn is used for Mexico’s processing sector. Over the last three marketing years, 90% (on average) of U.S. corn shipped to Mexico consisted of #2 yellow corn. In contrast, only 5.4% (on average) of U.S. corn exported to Mexico was white corn during the same period. Overall, the U.S. supplies most of Mexico’s total corn imports.

Looking Forward

Despite the lower U.S. corn export forecast for the current marketing year, compared with the previous month’s projection, exports are expected to reach a record high volume (2.550 billion bushels). If realized, 2020/21 corn exports would surpass exports from 2019/20 and 2018/19 by 43% and 23%, correspondingly. According to USDA, robust global demand, predominantly from China, as well as the impact of weather negatively affecting crops in Eastern Europe and South America are supporting U.S. corn exports this year. With more than seven more months to go until the end of the current marketing year, the U.S. corn export projection will most likely be revised in future reports. In addition, global corn prices have substantially increased this marketing year from a year ago, which could deter global corn import demand. Nevertheless, U.S. corn prices have remained the lowest among the major exporters (i.e., Brazil, Argentina, and Ukraine) and should keep U.S. corn supplies competitively priced in world trade.

[1] Outstanding export sales are contracts that have not been shipped at any given time during the marketing year.