posted by David Miller on Thursday, April 2, 2020

In March of 2020 I had the privilege to be one of the leaders of the Iowa Farm Bureau Federation 2020 Market Study Tour to Brazil. I serve as a consultant to Iowa Farm Bureau through Decision Innovation Solutions. Twenty-three of us travels to the heart of the Amazon and other areas along the Amazon River and in Mato Grosso to look at agriculture, transportation and grain handling infrastructure.

We began our study activities in Manaus. Manaus is a city of a couple million people deep in the heart of the Amazon. For all practical purposes nearly everything comes into and out of Manaus via river transportation. Manaus is situated on the Rio Negro just a few kilometers upstream of where the Rio Negro merges with the Amazon River. It is the home to a large Honda manufacturing plant and is a major manufacturing center for electronics and electronic equipment that is sole throughout South America and around the world.

We spent a couple days in Manaus learning about the Amazon River and about the environment of the Amazon. We learned that the Amazon River has a very distinct seasonal rise and fall of river levels. Peaking in June, the average depth of the river is 120 feet and falls until the end of October when it typically is 30 to 40 feet less in depth. At the height of its rise, the Amazon River can be more than 30 miles wide. At the end of the dry season it can be as narrow as 7 miles wide at its widest point. The area covered by water more than triples between the dry and wet seasons.

Ocean going vessels regularly travel upriver to Manaus which is more than 900 miles from the Atlantic Ocean. Smaller ocean going vessels of 3,000 tons can travel as far upriver as Iquitos, Peru which is 2,250 miles from the Atlantic Ocean. Smaller river boats can go another 486 miles upriver to Achual point.

There are a number of grain terminals and ports along the Amazon River. We visited the Cargill facility at Santarem. They load out about 75-90 ships per year with soybeans and corn from Mato Grosso and the state of Para near Santarem. Much of the corn and soybeans handled at Santarem arrives via river barges from tributary river ports at Miritituba on the Tapajos River and Porto Velho on the Madeira River. Each of the river barges carries 3,000 metric tons of grain and it takes 5 days for a round trip from Miritituba to Santarem and 12 days for a round trip from Porto Velho. The port at Miritituba is about 1,000 km from the primary soybean growing areas of Mato Grosso and the stories are legend of trucks traversing BR-163, “The soybean highway” the runs from the south of Mato Grosso up to Miritituba. Just a few months ago, the final leg of BR163 was finally paved after 30+ years of work on paving this major soybean thoroughfare. There are 6 new privately-owned terminals in Miritituba that load barges headed to Amazon River terminals of ADM, Bunge, Cargill, Louis Dreyfus and others.

Figure 2, Trucks Lined Up and Waiting to Unload at the Barge Terminals at Miritituba

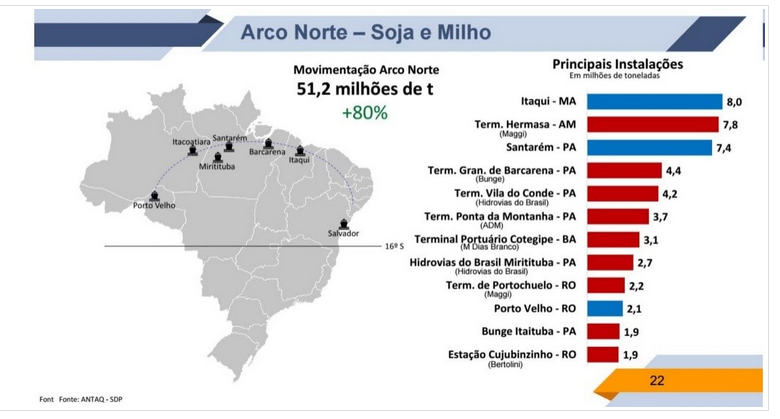

The Northern Arc of Brazil is rapidly emerging as a major exporting region for soybeans and corn from Brazil. In 2019, 51.2 million tons (about 1.9 billion bushels) of corn and soybeans were shipped fro the Brazilian Norther Arc ports. This was an increase of 80% from the previous year.

Things I Learned on the IFBF Brazil Market Study Tour:

- The Amazon River is BIG (and I mean REALLY BIG). It is hard to comprehend just how big the river is until one sees it.

- The Rio Negro River is also BIG and it is just a tributary of the Amazon.

- Ocean freighters can travel upriver into the port at Iquitos, Peru, some 2,300 river miles from the mouth of the Amazon. It is the worlds' most inland port that is serviced by ocean-going vessels.

- Rivers are the “roads” of the Amazon

- The meeting point of the Rio Negro and the Amazon River is impressive to see. It takes about 10 km for the waters of the two rivers to “merge”.

- Bad roads can be “really bad” to travel on.

- There are NO bridges across the Amazon River. There is a bridge across the Rio Negro River at Manaus, but no bridges across the Amazon River at least from the Atlantic Ocean to Iquito, Peru.

- Mato Grasso grows a lot of soybeans; but now is increasing corn and cotton production at a faster rate than soybeans.

- Corn-based ethanol is rapidly expanding in Brazil and is very competitive with sugar-based ethanol.

- Roads and railroads really matter. As Brazil improves its infrastructure, the remote areas of Brazil become much more competitive in world markets

- Ag is very involved in conservation in Brazil.

- There is a lot of no-till

- There is a lot of “preserved areas”

- In Amazonia, farmers can only develop 20% of their land; 80% must be preserved.

- In Mato Grosso, farmers can only develop 65% of their land; 35% must be preserved.

- Brazil has a large cattle herd and as corn and ethanol production increases in Mato Grasso, so will feedlot finishing of cattle. This could greatly expand beef production in Brazil.

- Floating storage is a key element of Amazon River grain handling.

- The Amazon river barges hold 3,000 metric tons (110,000 bu).

- Cargill at Santarem uses 50+ barges as “floating storage” and can unload 2 barges at a time into ocean freighters

- Cargill at Santarem receives barges from two tributary rivers at the ports of Miritituba and Porto Velho

- It takes 5 days for a roundtrip from Miritituba and 12 days for roundtrip from Porto Velho.

- Nearly all soybeans in Mato Grosso and the Northern Arc of Brazil are 1st crop soybeans.

- 2nd crops are corn and cotton.

- Soybean area is still expanding, but most of the new soybean area is a conversion from pasture, not from rainforest.

- Pasture conversion to cropland may increases as the economic viability of 2nd crops (corn and cotton) improves.