posted by S. Patricia Batres-Marquez on Thursday, February 1, 2018

According to the latest World Agricultural Supply and Demand Estimates Report (WASDE) published by USDA on January 12, 2018, 2017/18 U.S. soybean production is estimated at 4.392 billion bushels, down 33 million bushels compared with the previous month due to lower yields, but up 96 million bushels from the 2016/17 estimate (4.296 billion bushels). 2017/18 yield was down 0.4 bushel to 49.1 bushels per acre on account of reductions for Kansas, North Dakota, and South Dakota. The current marketing year U.S. soybean crush forecast was up 10 million bushels to 1.950 billion from the December forecast. Despite the higher crush forecast, estimated lower extraction rate left soybean meal production unchanged from last month at (46.099 million short tons). U.S. soybean exports are reduced 65 million bushels to 2.160 billion from last month’s forecast and 14 million bushels from last year’s estimate (2.174 billion bushels). From the beginning of the 2017/18 marketing year through December, sales commitments are lower year over year, with Brazil’s competition stronger during that period. Ending stocks are forecast up 25 million to 470 million bushels from the December forecast.

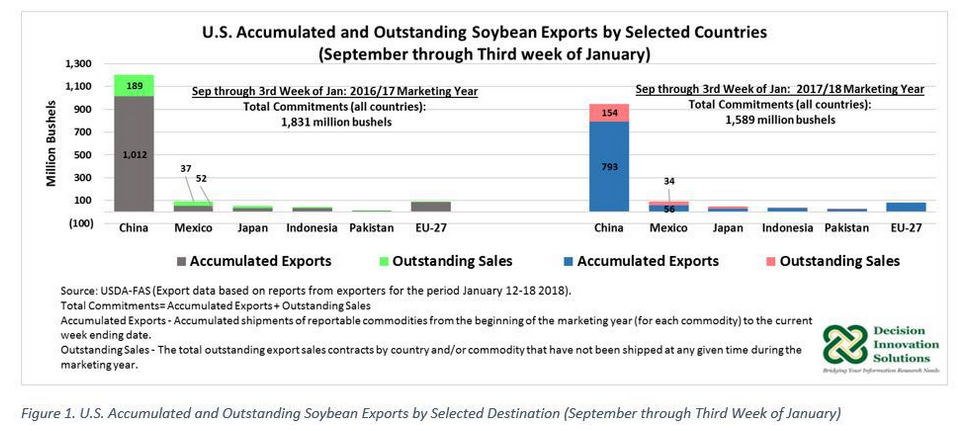

Based on export data for the period January 12-18, 2018, published by USDA-FAS and shown in Figure 1, U.S. soybean exports are lagging behind last marketing year. U.S. total commitments (accumulated exports plus outstanding sales) so far (September 1, 2017 to third week of January 2018) reached a volume of 1.589 billion bushels, down 243 million bushels compared with last year (1.831 billion bushels). Accumulated soybean export data through the third week of 2018 indicates shipments to China, the main destination for U.S. soybeans and the largest world importer of soybeans, were down 219 million bushels (21.6 percent) to 793 million bushels compared with the same period in the 2016/17 marketing year (1.012 billion bushels). In addition, outstanding sales to China through the third week of January 2018, were also down 18.2 percent to 154 million bushels year over year (see Figure 1).

In the 2016/17 marketing year, U.S. soybean exports to China reached a volume of 1.332 billion bushels ($14.573 billion), and represented 61.3% of total 2016/17 U.S. soybean exports (2.174 billion bushels). Fifty percent (50.6 percent) of U.S. soybean production was exported last marketing year to all markets, with China’s shipments representing 31 percent of U.S. soybean production.

According to USDA-FAS, the decline in exports to China this marketing year is mainly due to last year’s record soybean crop in Brazil, increasing total supply by 647 million bushels from 3.546 billion bushels in 2015/16[1] to 4.192 billion bushels in 2016/17. Moreover, USDA-FAS reports that with that large supply, Brazil exported about 404 million bushels from September to December 2017 compared with 125 million bushels during the same period the previous year. Eighty-six percent (350.5 million bushels) of Brazil’s soybean exports during the last four months of 2017 were shipped to China, limiting soybean trade from the United States during the period. The World Agricultural Supply and Demand Estimates Report (WASDE) published by USDA on January 12, 2018, indicated Brazil’s exports during 2017/18 (2.462 billion bushels) will increase 6 percent to 2.462 billion bushels from the previous year although production is expected to decline 3.6 percent to 4.042 billion bushels.

The next U.S. export sales report is scheduled for release by USDA on Thursday, February 1, 2018.

New Procedures for U.S. Exports to China

In September 2017, China notified USDA’s Animal and Plant Health Inspection Service (APHIS) about increased presence of quarantine weed seeds in the U.S. soybean imports they receive. To address China’s concerns, and at the same time to continue U.S. soybeans moving to that country without interruption, USDA-APHIS brought together a federal-industry working group to develop practical recommendations. These recommendations, which are called a systems approach, include measures that apply throughout the U.S. soybean supply chain and in China to effectively reduce weed seeds of quarantine concern to China. China accepted USDA’s recommendations in December 2017, ensuring the continued exports of U.S. soybeans to that country.

The systems approach began January 1, 2018, and as Table 1 shows, participants across the U.S. grain supply chain and in China are responsible for the implementation of the new approach, which begins at the farm level, continues through U.S. export terminals and includes China’s ports of arrival. Currently, APHIS is working with federal, state, and university experts to develop specific recommendations for soybean production and harvesting. These recommendations aim to reduce weed seed contamination at the farm level. APHIS will provide these recommendations to U.S. producers before the 2018 soybean growing season begins. According to USDA-APHIS, China’s standard for foreign material (FM) is 1 percent. This means that for China-bound U.S. soybeans, the new procedures require APHIS to notify China when a soybean shipment has more than 1 percent FM. This involves including an additional declaration on the phytosanitary certificate indicating, “This consignment exceeds 1 percent foreign material.” With this notification, U.S. soybeans exports to China will proceed without interruption until the United States is able to fully implement the science-based systems approach, during the 2018 crop year. The systems approach includes possible inspection, cleaning, treatment or other protective measures by China to abate weed seed risk in shipments with more than 1 percent FM.

The effectiveness of the systems approach which is crucial for uninterrupted U.S. soybean shipments to China, will be evaluated by both USDA-APHIS and China’s General Administration of Quality Supervision, Inspection and Quarantine (AQSIQ) in December 2019, with a midpoint assessment in December 2018.

[1] Brazil’s marketing year adjusted to an October-September year.

This article was originally published here: https://www.iowafarmbureau.com/Article/US-Soybean-Exports-Lag-Behind-Last-Marketing-Year