posted by David Miller on Tuesday, March 14, 2023

Iowa Grain Buyers and Corn Basis

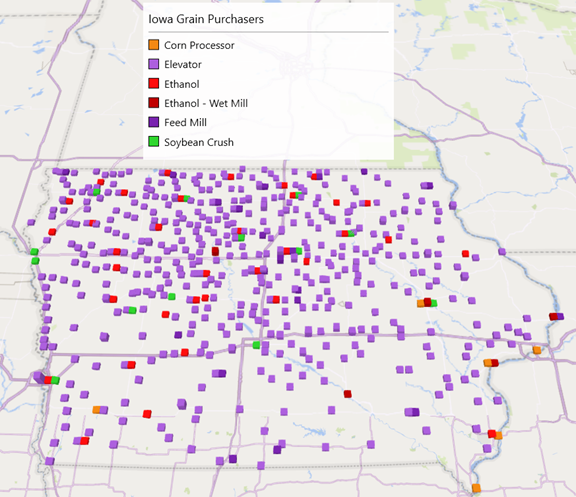

There are roughly 580 grain buyers in Iowa who post their daily bids on-line (on their own websites and/or on other grain marketing news and information websites). This map represents where those grain buyers are and the type of firm that they are. The majority of the grain buyers are elevators that provide markets for both corn and soybeans – it should be noted that many elevators also have an associated feed mill, but for this graphic, places that are just a feed mill are highlighted differently than elevators. There are 42 ethanol plants in the state and several large corn processors that just buy corn (as well as a few feed mills). There are 17 active soybean crush facilities that buy just soybeans.

Figure 1. Iowa Grain Buyers

Corn Basis

Corn Basis is the difference between the local cash price and the nearby futures contract price, and accounts for changes in the supply and demand in local markets relative to the reference price market. Basis tends to be the weakest (most negative or less positive) just after harvest (as local supply is at its largest), and then tends to improve (or strengthen) as the marketing year advances (while crop demands work through the supply). Differentials among basis at various demand points can stimulate (or discourage) movement of product from one location to another.

Basis levels tend to strengthen as the distance to demand centers is lessened. In the case of Iowa, historically that meant that the basis levels in the eastern part of the state tended to be higher than those for the northern and western part of the state due to near proximity to the export terminals in the Gulf. But as large interior demand points (ethanol plants) were developed basis patterns changed and northcentral and northwestern Iowa became the better basis markets and southcentral Iowa which has no ethanol plants became the weakest basis area.

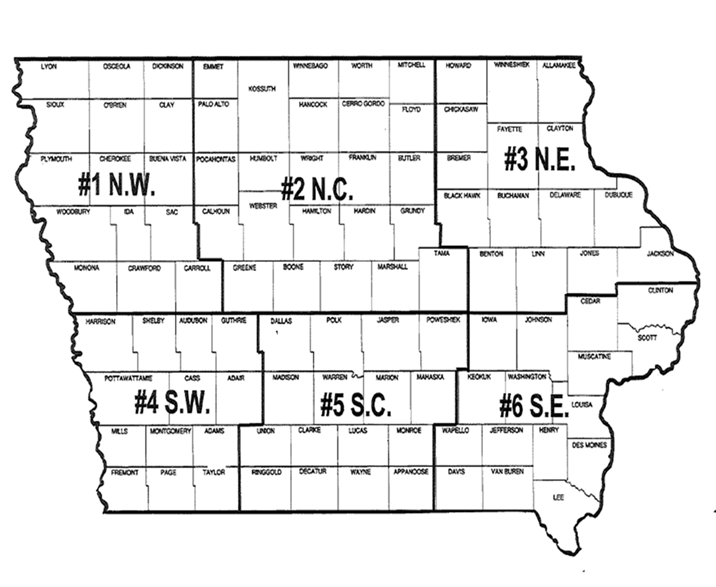

Figure 2. Iowa Basis Districts

The ethanol surge began in 2007, and as production grew over the next 5 years, corn basis overall improved in the Corn Belt (a rising tide truly does lift all boats). Expanded local corn demand for ethanol production promoted higher local prices, and therefore, improved the basis. For Iowa, corn basis strengthen overall during the 2007 to 2012 ethanol expansion period. Basis levels retreated quite a bit during the slump in corn prices 2014-2019 and during the trade war with China but have strengthened substantially since Russia invaded Ukraine with accompanying disruptions in corn supplies from the Black Sea area (Figure 2).

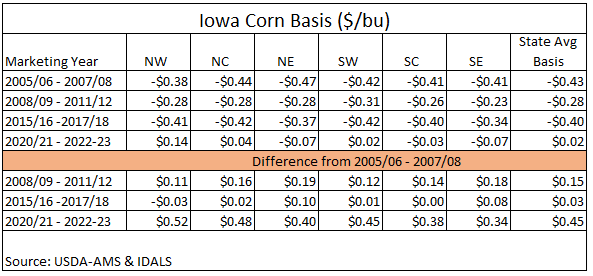

Compared to the 2005 – 2007 marketing years, statewide corn basis strengthened 15 cents in the period of ethanol expansion (2008 – 2011). Basis weakened during the slump in corn prices of 2015 – 2018 due to slowing growth in ethanol production, relatively good weather in all the major global growing areas and increased trade disruptions. And in the most recent period, basis has strengthened substantially with statewide basis 45 cents per bushel better than the pre-ethanol period and northwest Iowa 52 cents per bushel higher than pre-ethanol and northcentral Iowa 48 cents per bushel better than pre-ethanol levels. Southcentral and southeastern Iowa basis levels during the most recent 3-year period are better than pre-ethanol, but the weakness in exports has muted the impact in southeastern Iowa and the lack of ethanol production in southcentral Iowa has limited the basis gains there.

Figure 3. Iowa Corn Basis (Three-year averages)

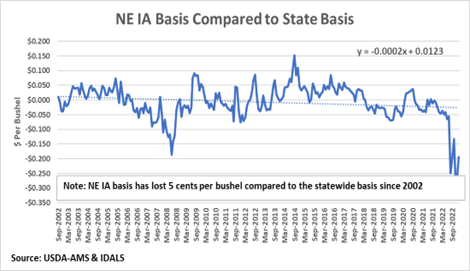

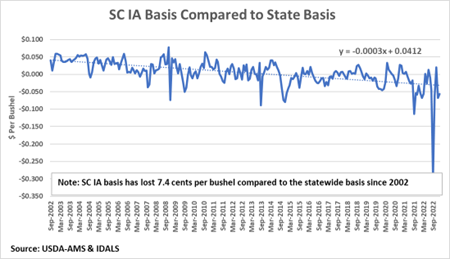

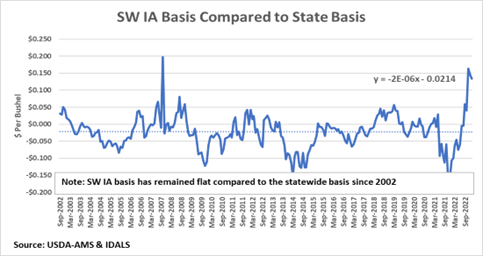

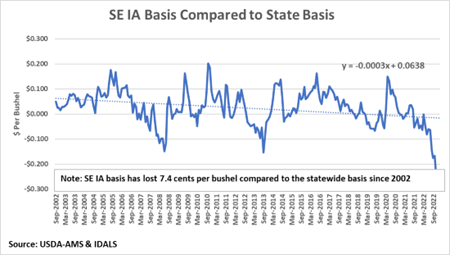

Regional Corn Basis Compared to the State Basis

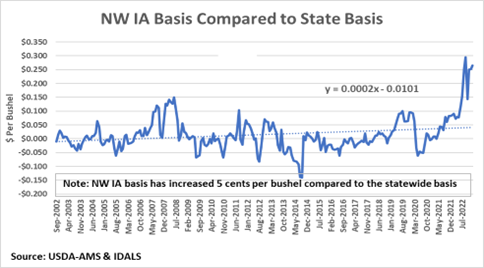

Over the past 20 years there have been shifts in how regional basis compares to statewide basis levels for corn. Basis levels in Northwest Iowa and Northcentral Iowa have strengthened versus the statewide basis. Southwest Iowa basis has a flat trend compared to the statewide basis. Northeast Iowa, Southcentral Iowa and Southeast Iowa have negative trends compared to the statewide basis.

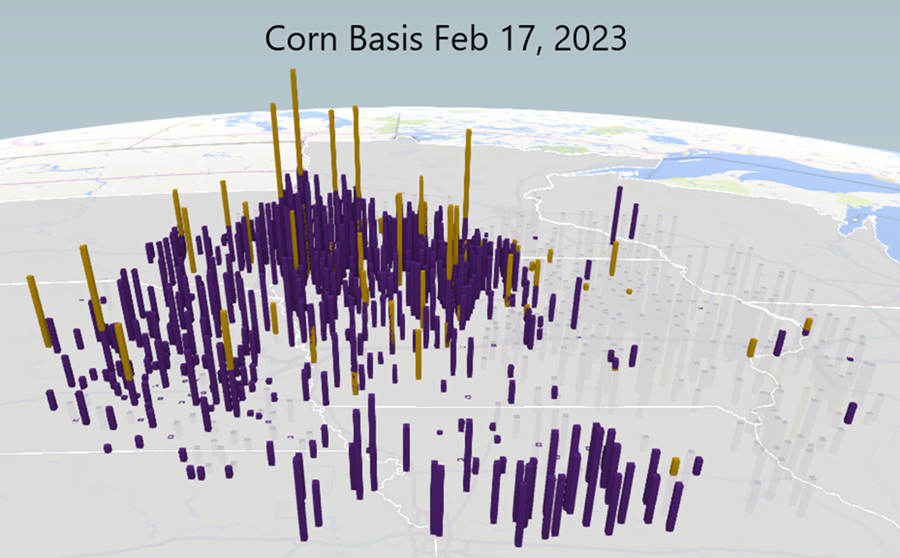

Figure 4 shows the corn basis for elevators and ethanol plants within a 250 mile radius of Fort Dodge, IA.

Figure 4. Corn Basis Feb 17, 2023

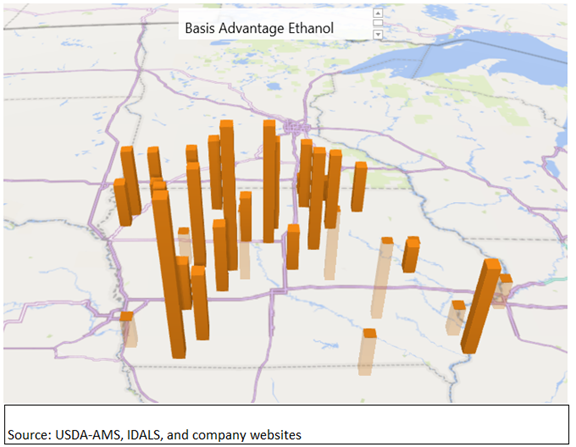

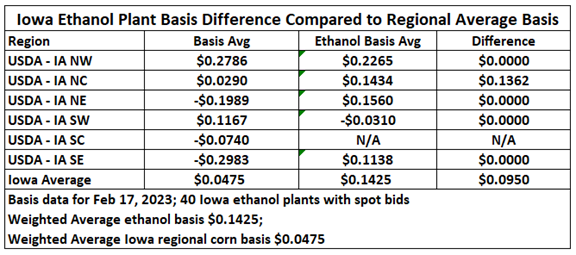

Basis levels in northwest Iowa and Northcentral Iowa are significantly positive, whereas corn basis levels in eastern Iowa and the western portions of Illinois and Wisconsin are negative. Also shown in Figure 4 is the premium (better basis) that, in general, is occurring at ethanol plants across Iowa, Nebraska and Minnesota. Figure 5 shows the advantage (better basis) that corn bids from ethanol plants exhibit when compared to the Iowa regional basis averages. Statewide, it is a 9.5 cent per bushel premium (Table 1).

Figure 5. Corn Basis Advantage from Ethanol

Table 1. Iowa Ethanol Plant Basis Difference Compared to Regional Average Basis

If ethanol plant corn bids are compared to the statewide average, the premium paid at ethanol plants is 16 cents per bushel greater than the statewide average corn bid.