posted on Monday, June 14, 2021

Recent trends experienced within the U.S. as a whole and within the state of Iowa go to show the important, and more prominent, role the agricultural machinery industry plays within the wider agricultural industry and economy.

U.S. Sales

The COVID-19 pandemic has resulted in widespread economic hardship across multiple industries: Many have faced the uncertainty of whether they would be able to maintain acceptable levels of production to serve their customers. Despite these negative trends seen in other industries, the 2021 U.S. market for agricultural machinery has been experiencing double-digit growth, outperforming previous years. According to the Association of Equipment Manufacturers, 39 percent more tractors and combines were sold between January and April compared to the same period last year – primarily driven by an increase in the sales numbers of tractors below 100 HP. During April alone over 40,800 farm tractors, and more than 480 self-propelled combines, were sold in the U.S. (Figure 1).

.png) Figure 1. US Tractor & Combine Sales

Figure 1. US Tractor & Combine Sales

Iowa Exports

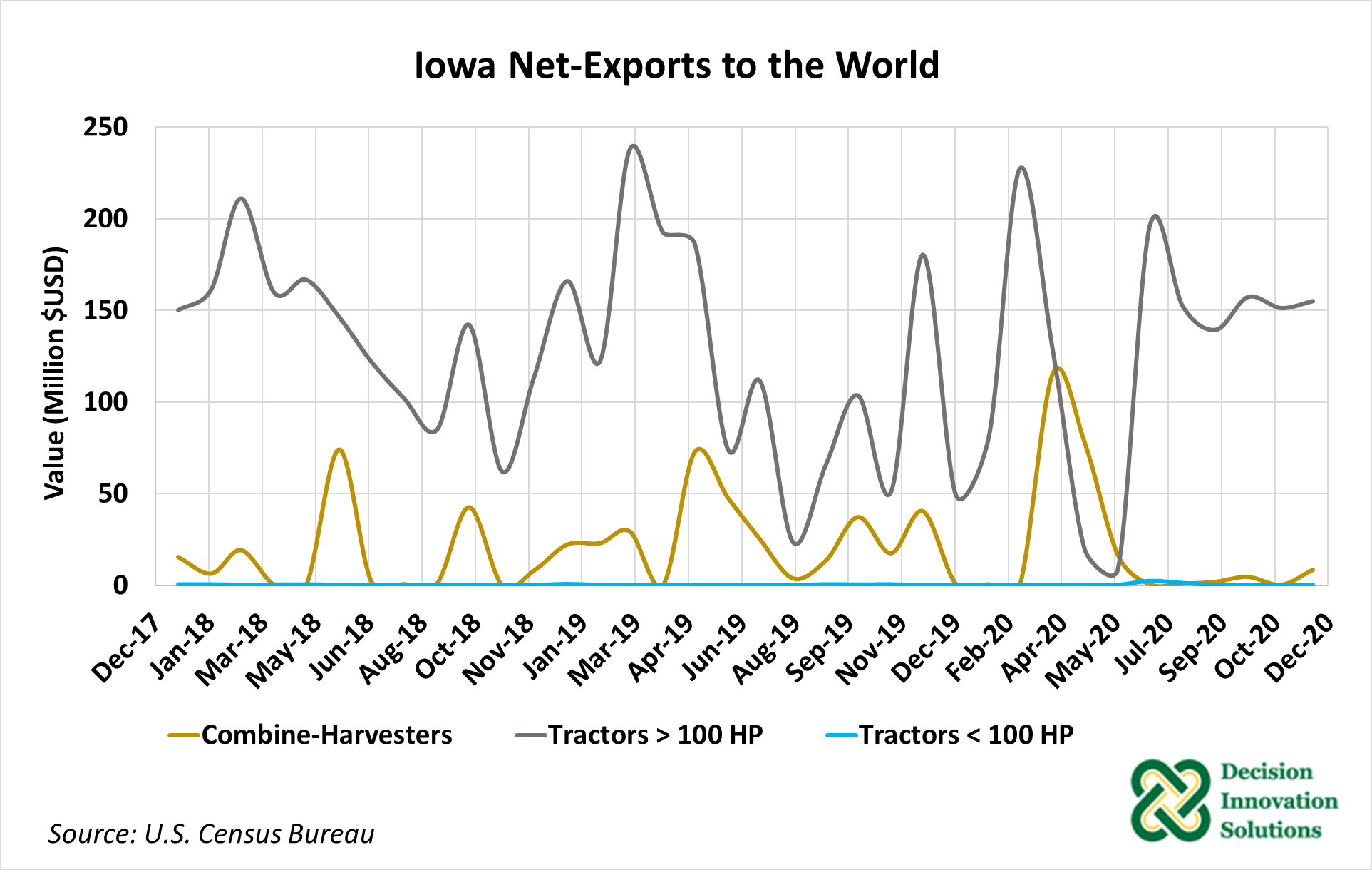

Iowa is a major exporter of agricultural equipment and machinery: According to the U.S. Census Bureau, 2020 exports of tractors and self-propelled combines from Iowa generated over 1.7 billion dollars. Exports of tractors – greater than 100 horsepower – and combine harvesters continue to support Iowa’s position as a net exporter of agricultural equipment and machinery (Figure 2) – It is important to note that in some cases credit for export is the point where shipments are consolidated, not where they are manufactured.

As agriculture equipment manufacturers continue to incorporate better technologies and increase fuel economy, demand for tractors and harvesters is forecasted to grow. Moreover, Grand View Research reports that harvesters will have a 21 percent share of the agriculture equipment market value by 2025.

Figure 2. Iowa Net Exports of Tractors

Figure 2. Iowa Net Exports of Tractors

Iowa Tractor Uses

Tractors and combines have become crucial elements of many agricultural operations throughout the United States. These machines provide mechanical power for performing a variety of tasks such as plowing, planting, harvesting, and feeding. They also simplify these processes and make room for profit on farm enterprises.

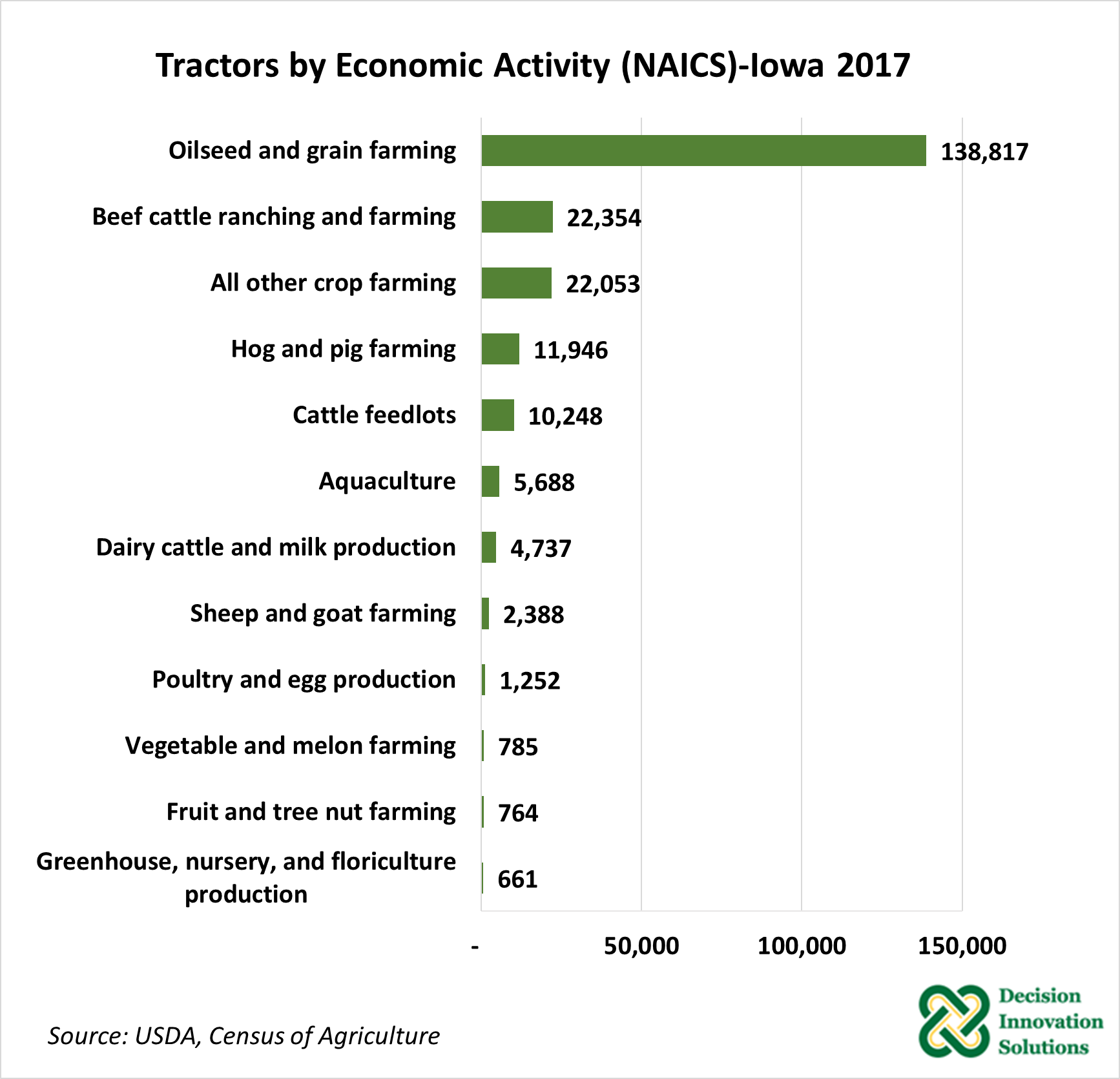

With Iowa as a leading state in crop and animal production, it is understandable that tractors and combines are essential to many operations. Following the pattern for the entire U.S., Iowa’s agricultural producers in oilseed and grain farming owned most of the tractors in the state in 2017 (Figure 3). Pre-harvest and post-harvest machinery are essential in these enterprises. Beef cattle ranching/farming and other crop farming, which includes hay farming, are the next agricultural activities with the largest number of tractors in Iowa.

Figure 3. Tractors by Economic Activity (NAICS) - Iowa

Figure 3. Tractors by Economic Activity (NAICS) - Iowa

Iowa Agricultural Machinery Numbers

According to census data, in 2017 there were 221,693 tractors and 34,960 self-propelled combines in Iowa. Sioux, Dubuque, and Kossuth counties lead the state with the total number of combines and tractors in inventory during 2017 (Figure 4). Although the total number of farm operations and tractors in Iowa has decreased since 1997, the number of large tractors (greater than or equal to 100 PTO horsepower) has increased in the same period in agricultural activities. Considering the large number of, and many applications for tractors across the state, it is also notable that census data shows that Iowa’s agricultural land, building, and asset values have more than quadrupled since 1997.

.png) Figure 4. Total Tractors and Combine Harvesters - Iowa

Figure 4. Total Tractors and Combine Harvesters - Iowa

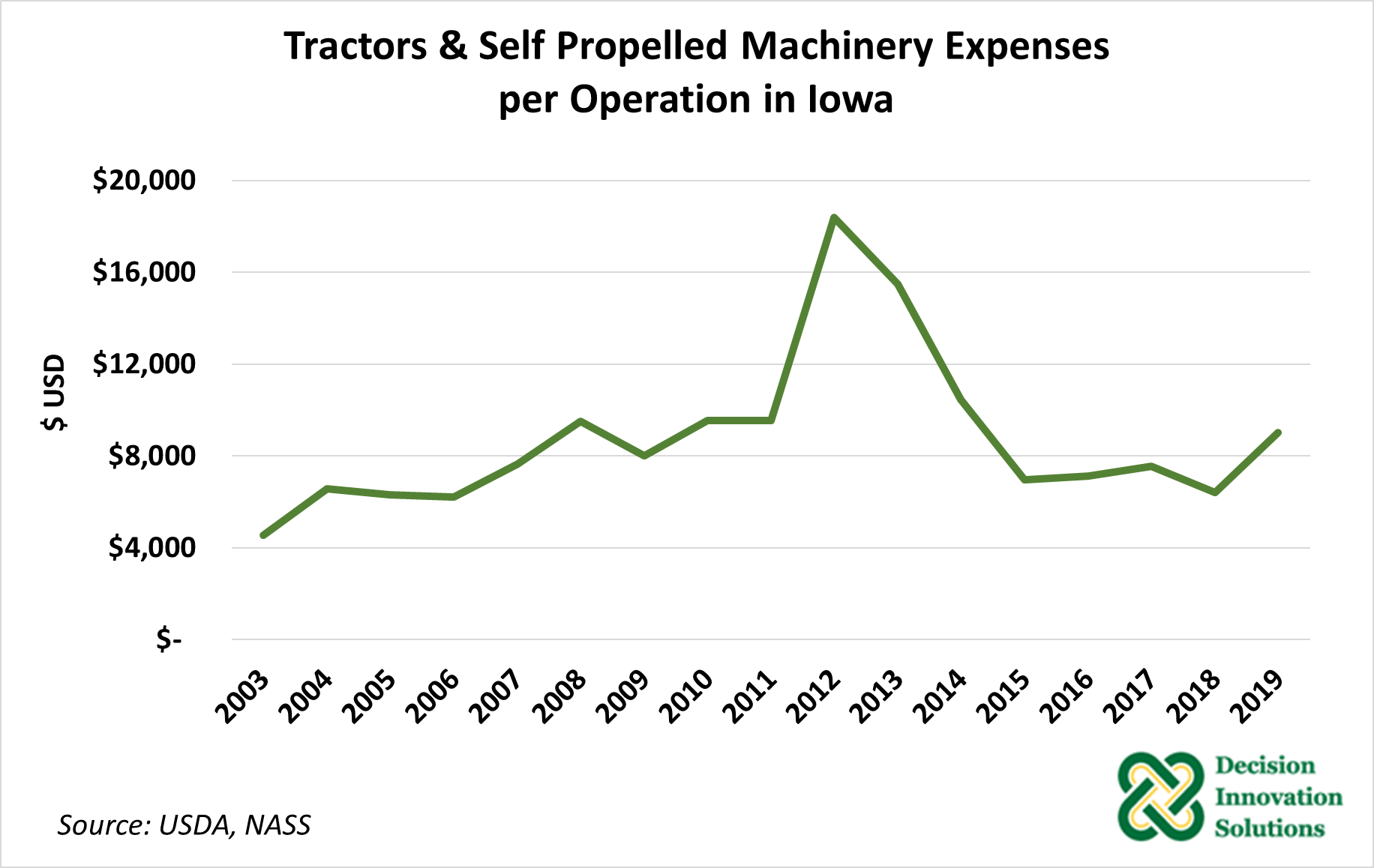

Iowa Tractor Expenses

Tractor expenses in Iowa have fluctuated since 2003. Over the fifteen years, the share of production expenses was highest in 2012 with 6 percent of production expenses being tractor expenses. During the last five years, the average tractor expenses were about 2.4 percent of production expenses. Figure 5 shows the variations of tractors and other self-propelled machinery expenses per operation since 2003. The decade-high per operation annual expense was over $18,000 in 2012 for tractors and self-propelled machinery expenses.

Figure 5. Tractors & Self-Propelled Machinery Expenses per Operation - Iowa

Figure 5. Tractors & Self-Propelled Machinery Expenses per Operation - Iowa

U.S. and Iowa Tractor Demographics

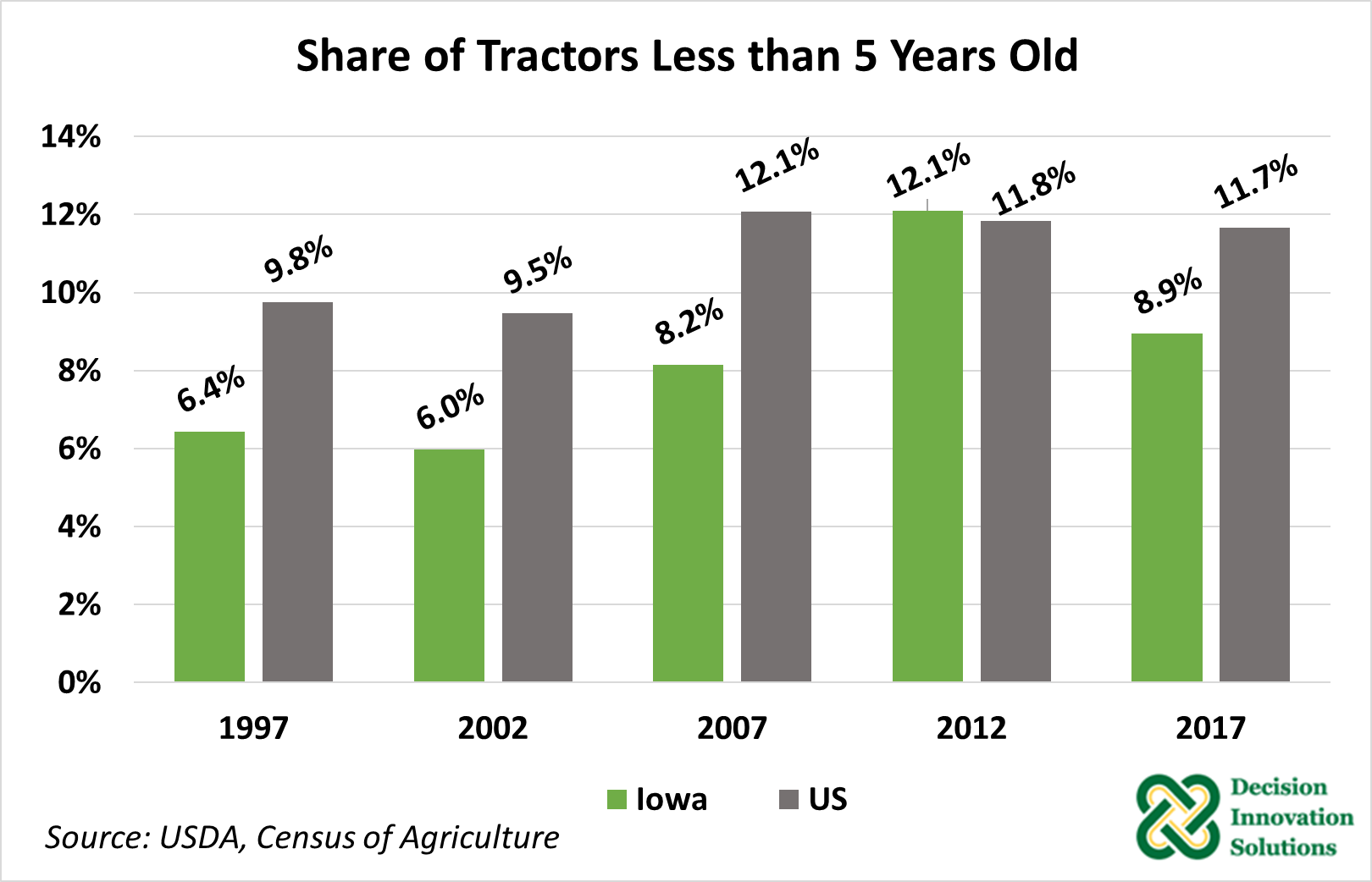

According to census data, around 12 percent of the tractors in the U.S. are less than 5 years old (Figure 6). Within the State of Iowa, tractors less than five years old make up around 9 percent of the total – an increase since 1997. Advancements in technology and precision farming are likely supporting factors for the increase in new tractors. Along with this, keeping machines while under warranty helps producers avoid costly repairs not covered by warranty. Lastly, the demand for tractors may also be attributed to pressures from global population increase and the need to produce more food to feed the world.

Figure 6. Share of Tractors Less than 5 Years Old

Figure 6. Share of Tractors Less than 5 Years Old

Technological Advancements

Tractors and combines have undergone many changes over the years. Advancements like GPS guidance, onboard monitoring systems and assisted steering have helped to increase farming efficiency and precision. Greater connectivity via the IoT (internet of things) as a tool to exchange data information between devices is incorporated in planters, sprayers, combines, and tractors. The benefit of this technology is that operators can anticipate failures before they happen and quickly diagnose failures if they occur. IoT technology allows combines to, for example, make internal adjustments automatically as sensors tell the machine to adjust the sieves. Implementing IoT into agriculture machinery has improved productivity and reduced other expenses.

As these machines become more advanced, increases in the expenses of the machinery have been observed according to USDA, NASS reports. It is important that farmers and ranchers extract added value from these technologies to ensure efficiency. Multiple companies are researching technologies for the next generation of farm equipment. Innovations in large farm equipment such as driverless operation – which may help alleviate labor shortages, or all-electric tractors – which provide environmental and potential performance benefits, leave much to look forward to for the future of tractors and combines.

- ag machinery

- combine

- expenses

- exports

- industry

- iowa

- sales

- tractor

- trends

- u.s.