posted by Jing Tang on Monday, April 1, 2024

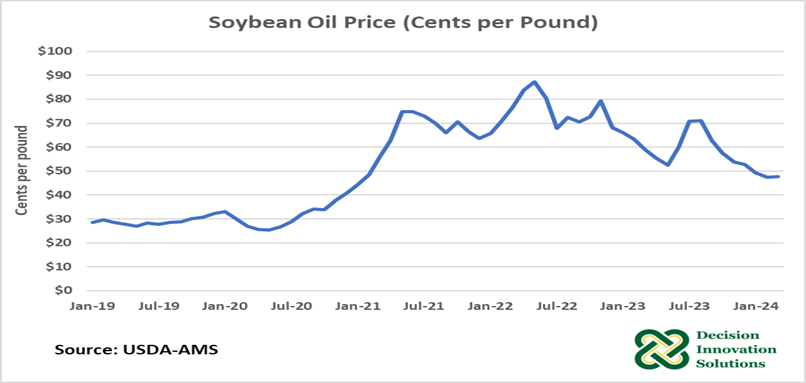

Soybean oil prices increased almost three times more in the summertime of 2021 compared to prices before 2021. Soybean oil prices hit almost $0.90 per pound, after hovering around $0.30 per pound as shown in Figure 1. Soybean oil prices have since cooled off to around $0.53 per pound in May 2023, and then rose back towards $0.70 per pound by July 2023, since then soybean oils dropped down to $0.47 per pound by March 2024.

Figure 1. Soybean Oil Price (Cents Per Pound)

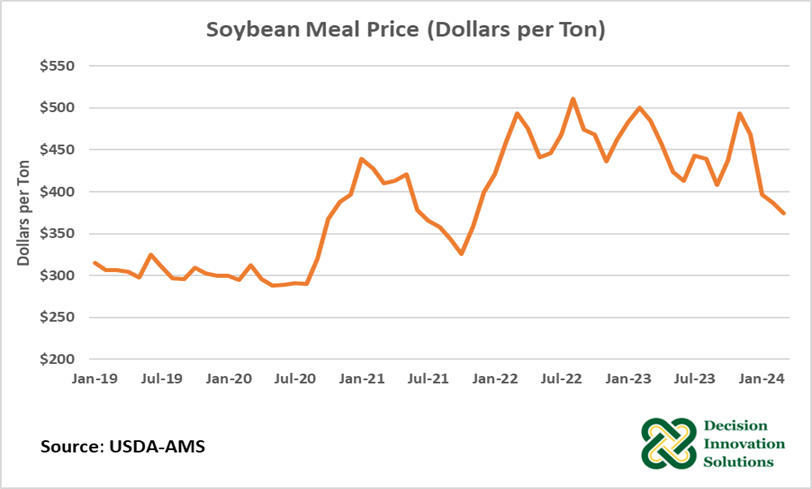

Soybean meal prices increased in the summer of 2021 compared to prior years but not as aggressively as soybean oil which is shown in Figure 2. Soybean meal price rose back to $493 per ton at the end of 2023, then fell back to $374 per ton in March 2024. Around May 2023, soybean oil prices dropped down, while soybean meal prices gained some ground. This has shifted the relative value of soybean oil down slightly, to around 45% of the value of crush, but soybean oil still makes up a much larger percentage of the total crush value than it historically has.

Figure 2. Soybean Meal Price ($ Per Ton)

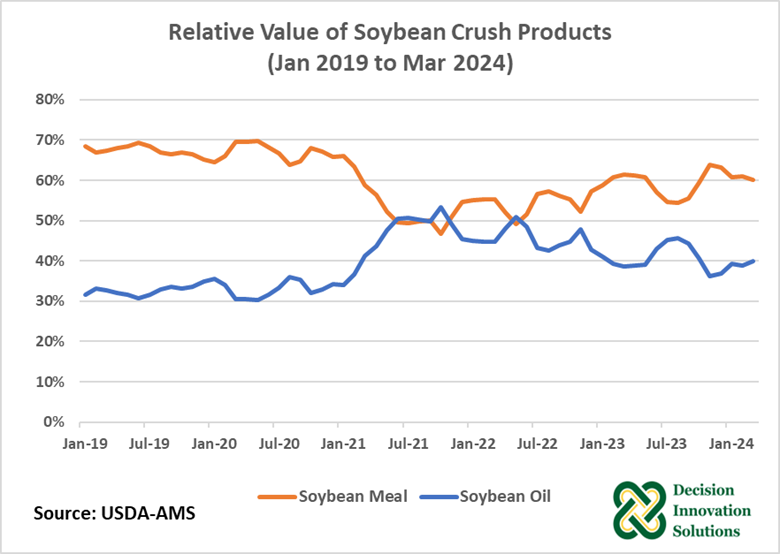

The soybean crush produces two major products, soybean meal and soybean oil. Historically, a little over two thirds of the total value of soybean crush products came from soybean meal and the remaining one third came from soybean oil (Figure 3). In Jan 2021, soybean oil began gaining ground on soybean meal, and by the summer of 2021 the products each made up half of the total value of the crush. This was primarily due to large increases in the price of soybean oil.

Figure 3. Relative Value of Soybean Crush Products

At the beginning of 2022, the relative value of soybean meal became higher than the relative value of soybean oil, similar to the relationships of the products before 2021. But more seasonality showed up, around midyear 2022 when the relative value of soybean meal went up from 51% in November 2021, to 55% in May 2022, then back to 49% in November 2022.

This seesaw pattern in the price of soybean meal continued through the end of 2023. The changes of relative value of soybean oil changed in the opposite direction as soybean meal did, at the same points in time. Entering 2024, the gap between relative values of soybean oil and soybean meal got larger. Looking forward, the question remains unanswered as to whether the relative values of soybean meal and soybean oil will go back to historical relationships in which meal was about 66% of the value of the crush and soybean oil was 34% of the value of the crush or will meal values stabilize at 50 to 60% of the value of the crush and soybean oil at 40 to 50% of the value of the crush.

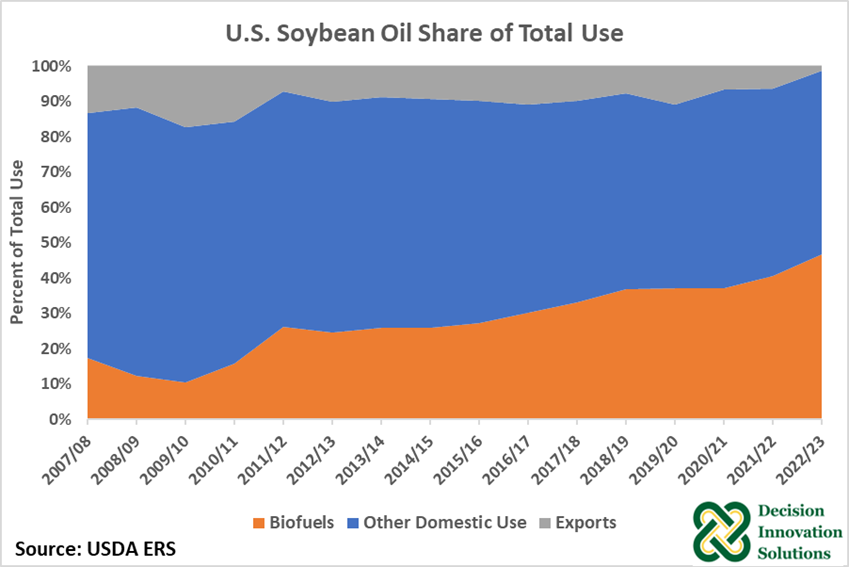

The primary reason for the increase in the price and relative value of soybean oil, is the increased demand from the biofuels industry. The production of biofuels made from soybean oil as substitutes for diesel fuel are increasing, the most notable being renewable diesel fuel. The percentage of domestic soybean oil used for biofuels has increased approximately 19% from 2015 to 2022 (Figure 4).

Figure 4. U.S. Soybean Oil Share of Total Use

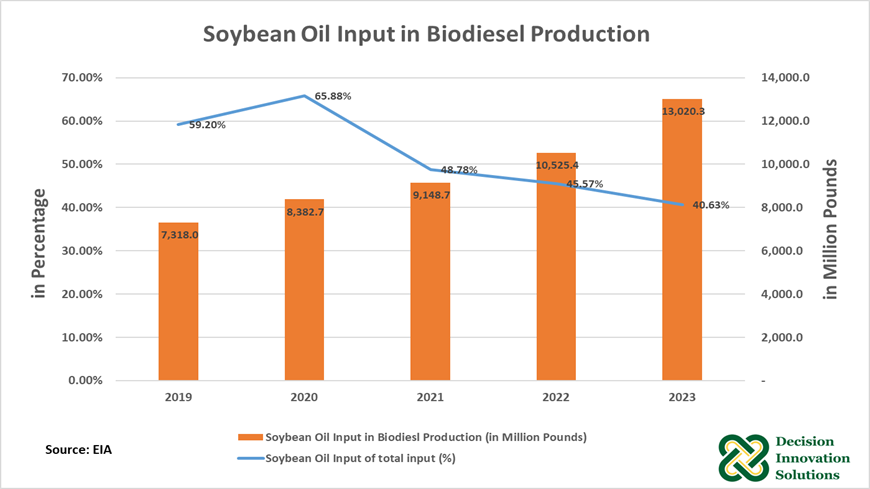

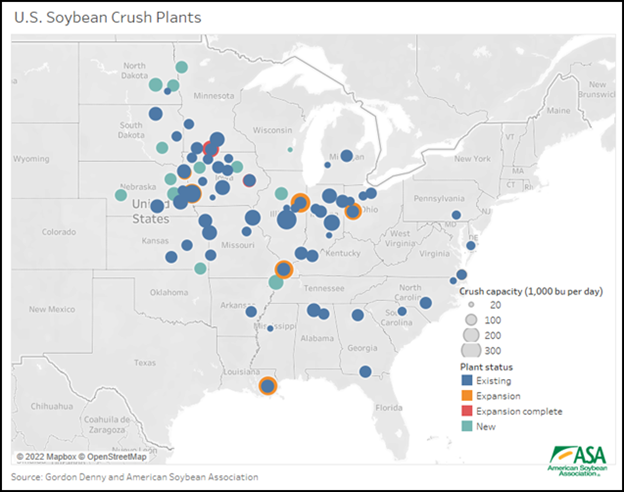

With the growing biofuels industry, soybean oil used for biodiesel increased from 7,318 million pounds (59% of total inputs) to 13,020 million pounds (41% of total input) from 2019 to 2023, shown in Figure 5. Soybean crush is expected to increase in the coming years with much of this increase in domestic crush driven by a desire to have more soybean oil available for domestic biofuel production. Including expansions and new plants, plans for a total of 677 million bushels of additional crush capacity (compared to 2023) have been announced with 127.5 million bushels of the expanded capacity slated for locations in Iowa.

Figure 5. Soybean Oil Input in Biodiesel Production

Figure 6. Existing and Planned U.S. Soybean Crush Plants

Additional soybean meal crush is coming. Renewable diesel will likely provide needed demand for the additional soybean oil, but the market for additional soybean meal produced is not obvious yet. Domestically, most soybean meal is fed to livestock, and large growth in U.S. livestock numbers is not expected in the coming years. A failure to effectively market new soybean meal could lead to depressed soybean meal prices. Which could depress the price of other commodities including soybeans, DDGs, and corn.