posted by Decision Innovation Solutions on Monday, October 12, 2015

I am currently a part of the Master of Agribusiness program through Kansas State University. It is a program designed for working professionals, so I am able to take the courses from a distance which allows me to continue my full-time work with Decision Innovation Solutions.

This summer my classmates and I completed a course called Optimization Techniques for Agribusiness which helped us learn to construct and evaluate optimization models to provide quantitative support when making decisions. Now we are currently taking a course called Agribusiness Risk Management. This course looks at 7-steps (shown below) in evaluating risk-preference and applying risk management techniques such as hedging and options, insurance, and diversification.

1) Evaluate Financial Situation

2) Determine Risk Preferences

3) Set Goals

4) Prioritize Risks

5) Identify Risk Management Alternatives

6) Estimate Likelihoods

7) Rank Alternatives

Risk management is a crucial piece to every business, and should be revisited as the business grows and changes. I am able to directly apply these 7 steps to our work here at DIS when assisting clients. Our goal is to help you have the necessary information and data analysis to be prepared for potential risks in your business. Here are some ways that we can help you:

Economic impact studies help quantify the economic gains or losses to a specific scenario and also help assist businesses in understanding the impact of a change to their current economic environment.

Spatial analysis looks at evaluating how geography impacts a specific business. In addition to mapping locations or distances, we also investigate the resulting interaction and flows between locations to examine the trade-offs of a particular decision. Visualizing complex data sets provides the big picture as it relates to current or potential business practices.

Stochastic modeling reduces risk in decisions by adequately characterizing variables involved in the project. Using historical information and projections will allow you to look at relevant variables to determine potential outcomes based on your organization's level of risk. Additionally, complete thoroughness is achieved by solving the model enough times to give an accurate estimation of possible outcomes.

Feasibility studies explore the risks and returns associated with either the creation of a new business or the expansion of an existing business. Using stochastic modeling that is unique to the project allows for a truly customized feasibility analysis, not a snapshot approach used by many of our competitors. Instead we use a multiple-variable approach that goes in-depth to look at numerous variables including location, buying relationships and current business structure.

Economic contribution studies allows companies to take a snapshot of their current business environment and the linkages among industries for a pre-defined, specific period of time.

DIS optimization is a mathematical approach we use to understand the lowest cost, highest profit decision given a set of alternatives and constraints that will give you verifiable numbers to make decisions. We can help answer questions such as: What is the best mix of inputs? How can I minimize production costs? What is the best plant location to minimize transportation costs? What is the correct mix of products to optimize profits?

The more knowledgeable you are about your company's risks, the more prepared you are to face tough decisions as they come about. Additionally, having quality data helps you make informed business decisions when planning for your firm's future growth.

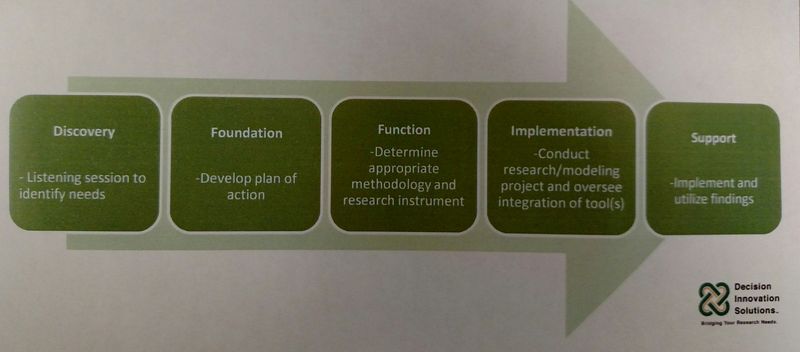

When working with us at Decision Innovation Solutions, you can expect to see us using this five step process to provide you with quality results that add value to your business.

- economic contribution

- feasibility study

- optimization

- risk management

- stochastic