posted by S. Patricia Batres-Marquez on Monday, April 3, 2023

Due to lower planted acres and yield, 2022/23 corn production was estimated at 13.73 billion bushels, which was down 9% year-over-year. With lower corn production, corn usage projections, including corn exports, have been reduced compared with the previous year; however, as indicated in the latest WASDE report (March 12, 2023) the share of corn for domestic usage, in particular corn for ethanol, relative to total production, is expected to increase from 35% during last marketing year to 38% in the current marketing year. In contrast, the share of corn exports is expected to decline from 16% during the previous marketing year to 13% this marketing year. The current WASDE report indicated a further decline in projected corn export volume in 2022/23 (1.85 billion bushels) from the previous month’s projection (1.925 billion bushels). The adjustment was based on the slow pace of sales and shipments during January and February 2023.

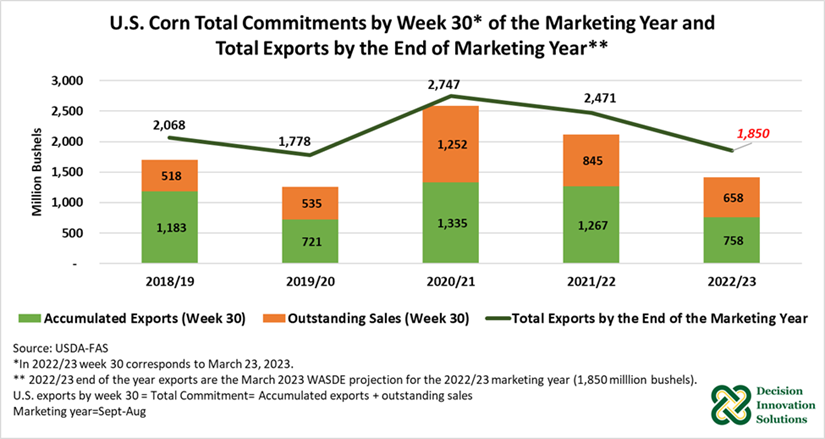

Based on USDA’s most recent trade data, which corresponds to the week ending on March 23, 2023 (week 30 of the marketing year[1]) and published March 30, 2023, U.S. total accumulated corn exports to all destinations were estimated at 758 million bushels, down 40.2% year-over-year (1.267 billion bushels) and down 43.3% from the same period in 2020/21 (1.335 billion bushels) (see Figure 1).

Total outstanding corn export sales contracts by March 23, 2023, were reported at 658 million bushels, which represented only 78% and 53%, respectively, of outstanding sales by the 30th week of the previous two years.

Figure 1. U.S. Corn Total Commitments by Week 24 of the Marketing Year and Total Exports by the End of Marketing Year

The most recent data indicates that total commitments by the 30th week of the current marketing year were estimated at 1.416 billion bushels, which were down 33.0% from last year (2.112 billion bushels) and down 45.3% from the volume during the same time in the 2020/21 marketing year (2.588 billion bushels).

Total commitments by March 23, 2023, made up 77% of the corn export projection for the 2022/23 marketing year (see Figure 1). Considering shipments are currently at 758 million bushels, only 41% of projected exports have been realized by the 30th week of this marketing year.

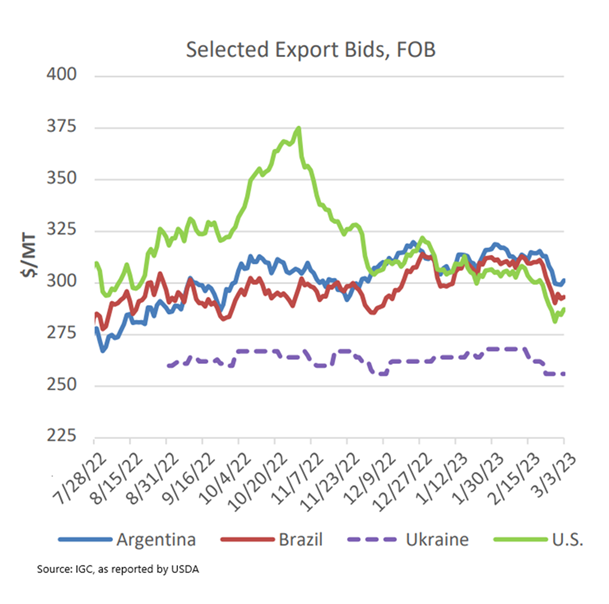

The combination of lower production and the negative impact on grain deliveries to foreign markets coming from the Midwest due to the low water levels in the Mississippi River during the fall of 2022, made U.S. corn prices less competitive (see Figure 2) and resulted in low total commitments (accumulated exports plus outstanding sales). At the peak, U.S. corn export bids were more than $100 per metric ton (MT) higher than corn available from Ukraine. Relative to Brazilian and Argentinean corn prices, U.S. corn prices have been consistently competitive since January 2023; however, U.S. corn export sales have continued sluggish. USDA indicated export inspection data during the first two months of 2023 was about 50% of the average sales during the same period in the previous two marketing years (2020/21 and 2021/22).

Figure 2 shows that at the beginning of March 2023, U.S. corn bids ($286 per MT) were below those of Brazil ($292/MT) and Argentina ($301/MT), but prices $30/MT higher than Ukraine’s corn bids ($256/MT).

Figure 2. Selected Export Bids, FOB

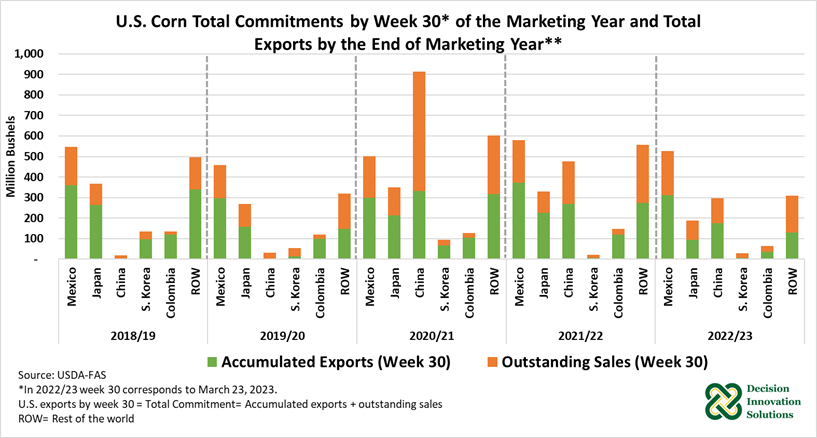

Figure 3 shows corn accumulated exports and outstanding sales by destination. Mexico has been the top market for U.S. corn, except in 2020/21 when China imported large volumes of U.S. corn and became the top market. Figure 3 also indicates that corn total commitments were down relative to the 2021/22 marketing year. Compared with the same week during the previous marketing year (30th week), total commitments were reduced for Colombia (-55.9%), China (-38.0%), Japan (-42.8%), and Mexico (-9.0%) but were up for South Korea (43.6%).

A note about Mexico corn imports: Mexico had planned to phase out GMO corn imports and the use of the herbicide glyphosate by January 2024. On February 12, 2023, Mexico removed the deadline to ban genetically modified corn for animal feed and industrial use; however, Mexico kept its plan to prohibit use of GMO corn for human consumption (flour, dough, or tortilla made from grain that is glyphosate tolerant). According to news outlet, the decree also indicated Mexico will revoke authorizations and permits to import, produce, distribute and use the herbicide glyphosate. This plan has been in place since 2020. The transition period would be in effect until March 31, 2024. Considering that between 80% to 82% of Mexico’s corn imports from the U.S. consist of yellow corn for animal consumption, with the remaining imports consisting of white corn for human consumption, this ban could potentially reduce U.S. corn exports to Mexico by about 20%. U.S. corn exports to Mexico averaged about 602 million bushels between 2018/19 and 2021/22.

News on March 29, 2023, indicated that the U.S. and Mexico started formal talks at the beginning of March. The deadline to resolve this dispute is April 7, 2023. Otherwise, the U.S. could file a formal complaint under the free trade agreement between the U.S., Mexico, and Canada (USMCA).

Figure 3. U.S. Corn Total Commitments by Week 30 of the Marketing Year and Total Exports by the End of Marketing Year

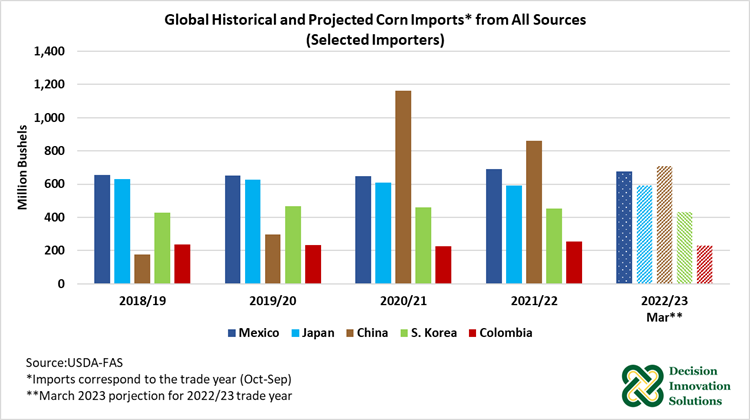

Global corn import projections are down. The latest (March 2023) global corn import projections from all sources during the 2022/23 trade year (October-September) indicate a decline of 7.3% to 7.078 billion bushels compared with last year. China is projected to reduce its corn imports by 17.7% to 709 million bushels compared with the previous trade year (Figure 4). Colombia, South Korea, and Mexico are forecast to reduce their corn imports relative to the prior year’s trade by 10.9% (to 228 million bushels), 4.5% (to 433 million bushels), and 2.1% (677 million bushels), correspondingly. Japan is expected to keep about the same level of corn imports at 591 million bushels (see Figure 4).

Figure 4. Global Historical and Projected Corn Imports from All Sources (Selected Importers)

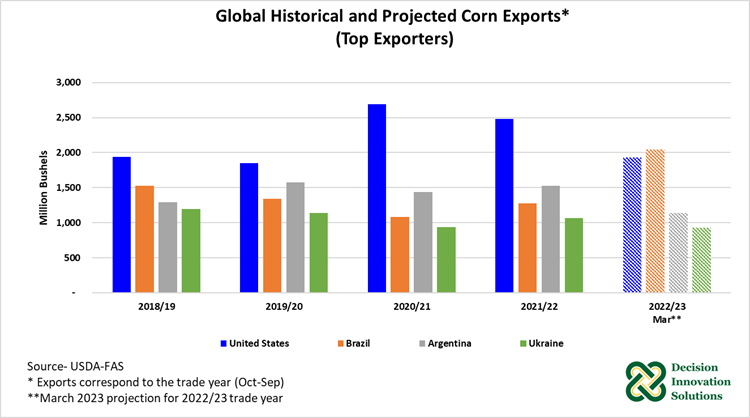

As reported by USDA, major corn importers, particularly China, have kept demand high for Brazilian corn this trade year. The March 2023 projection for Brazilian corn exports in 2022/23 trade year was increased to 2.047 billion bushels from the previous month projection (2.008 billion bushels) based on pace of trade and substantial February exports. The latest projections indicate that Brazil is expected to surpass the U.S. volume of exports (1.929 billion bushels) during the current trade year (see Figure 5). The only previous time Brazil outpaced U.S. corn export was in 2012/13, a time when the U.S. experienced a severe drought.

Figure 5. Global Historical and Projected Corn Exports (Top Exporters)

To achieve the projected volume of exports this marketing year, 49.65 million bushels of U.S. corn, on average, need to be exported per week during the remaining 22 weeks of the marketing year. If exports projections for the current marketing year are realized (1.850 billion bushels), they will be down 25.1% and 32.7% from the 2021/22 (2.471 billion bushels) and 2020/21 (2.747 billion bushels) volumes exported, respectively. U.S. corn exports in 2022/23 would be up 4% from the 2019/20 marketing year (1.778 billion bushels).