posted by S. Patricia Batres-Marquez on Thursday, August 18, 2016

About 22% of the total volume of U.S. production is exported every year making exports an important outlet for U.S. agricultural production. The main U.S. agricultural export products are grains and feeds, soybeans, livestock products, and horticultural products. The top five export destinations for these products are China, Canada, Mexico, Japan, and the European Union (see Table 1).

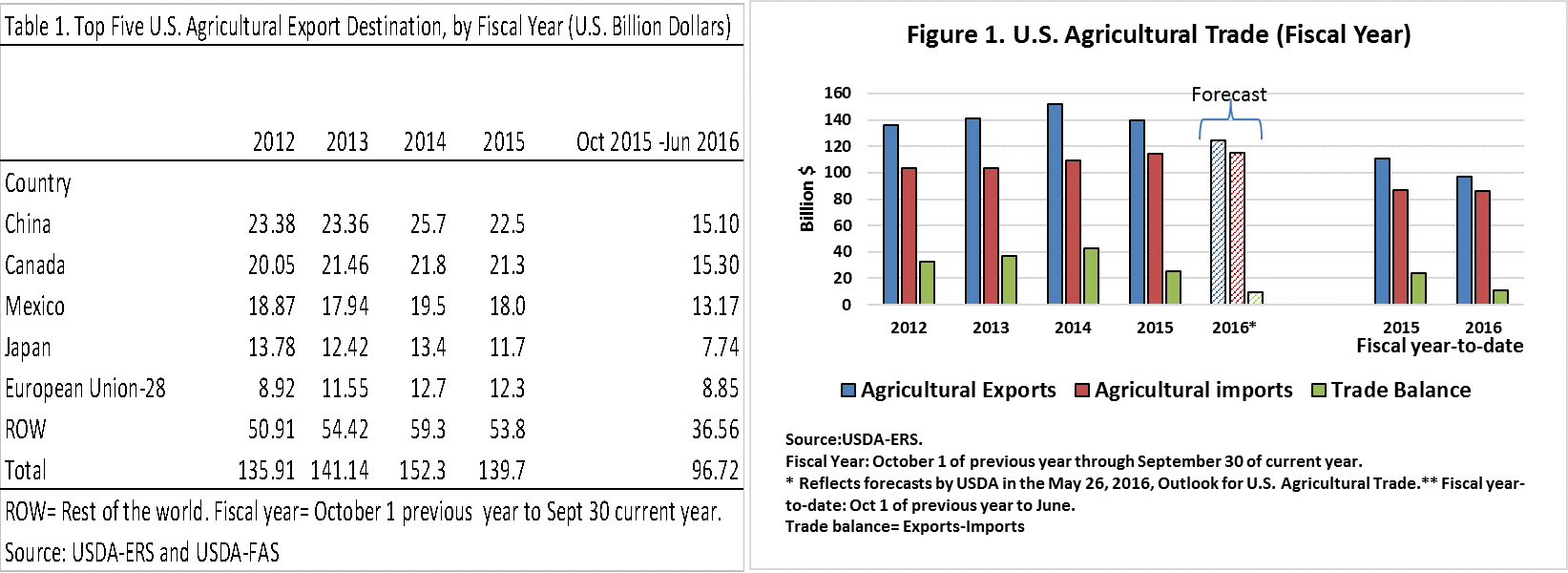

USDA reported its fourth and last forecast for U.S. agricultural exports for the 2016 fiscal year (FY, October 1, 2015 to September 30, 2016) in the Outlook for U.S. Agricultural Trade, published in May 2016. The forecast indicated that U.S. agricultural exports are expected to reach a value of $124.5 billion (see Figure 1). If projections are realized, they would be down $15.2 billion relative to 2015 ($139.7 billion), and $27.8 billion from the record value in 2014 ($152.3 billion) (see Figure 1).

U.S. agricultural imports on the other hand, are forecast at $114.8 billion which are up $0.774 billion from last year. The projected U.S. agricultural trade surplus (exports minus imports) is forecast at $9.7 billion. This would be the lowest trade surplus since 2006 ($4.566 billion).

The U.S. agricultural export forecast published in May 2016 was $14 billion below the first forecast for 2016 FY reported by USDA back in August 2015 ($138.5 billion). U.S. agricultural trade forecasts may be modified based on changes in factors that influence trade such as global supplies, commodity prices, government policies to support agriculture, and exchange rate fluctuations, among others. As indicated by USDA, most of the expected reduction in the value of U.S. agricultural exports for 2016 FY responds to lower commodity prices, strong competition, and reduced trade prospects with China, particularly for sorghum and distiller’s dried grains with solubles. The value of projected exports for livestock, poultry, and dairy were lowered in response to lower prices as a result of increased supplies. A strong dollar relative to weaker currencies in key markets also contributed to a lower forecast for the value of agricultural exports.

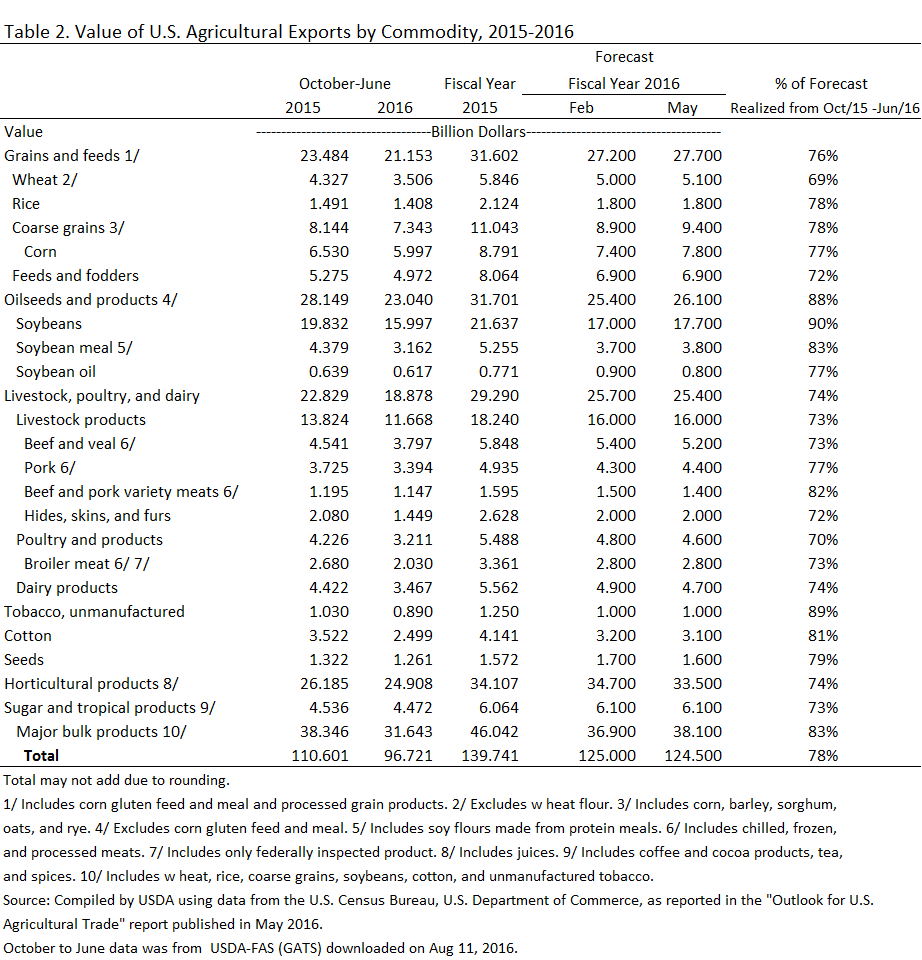

Changes in forecasts from February to May 2016 showed that grain and feed exports are expected to reach a value of $27.7 billion (up $500 million from the February forecast) (see Table 2). The last forecast adjustments were the result of larger volumes of wheat and corn and slightly higher prices for corn and sorghum. The latest data from USDA shows that during the first three quarters of the 2016 FY (October 2015 to June 2016), 76% of the U.S. export forecast for grains and feeds was realized (see last column of Table 2). Likewise, the value of U.S. corn exports ($5.997 billion) during this period represented 77% of the projected U.S. corn exports this FY ($7.800 billion).

U.S. exports of oilseeds and products are expected to reach a value of $26.1 billion, up $700 million from the February forecast on account of larger export volumes of soybeans and soybean meal and higher soybean prices. Ninety percent ($15.997 billion) of the U.S. soybean exports projected for the 2016 FY has been achieved from October 2015 to June 2016 (see Table 2), at this rate with three more months remaining in this fiscal year, U.S. soybean exports may surpass the forecast for 2016 FY ($17.7 billion).

U.S. livestock, poultry, and dairy exports are forecast at $25.4 billion this FY, down $300 million from the February forecast. As Table 2 indicates, 74% ($18.878 billion) of the projection for this sector was reached during the first three quarter of the 2016 FY.

Overall, there was $500 million reduction in the 2016 FY forecast for agricultural exports from the February to May 2016 (see Table 2).

Exports of major U.S. agricultural products, such as grains and feeds; oilseeds; livestock, poultry, and dairy; and horticultural products, are forecast down this fiscal year (2016) relative to the previous year. As indicated by USDA, lower commodity prices, strong competition, and weaker demand are pulling down the value of U.S. agricultural exports this fiscal year. Because of expected decline in the value of U.S. agricultural exports and the projected high record value of U.S. agricultural imports, the U.S. agricultural trade surplus is expected to be the lowest since 2006. Most agricultural commodity exports during the first three quarters of this fiscal year have reached more than 70% of their corresponding annual forecasts, with soybeans achieving most of its projection. USDA will publish its first agricultural export forecast for the 2017 fiscal year by the end of August 2016.