posted by S. Patricia Batres-Marquez on Tuesday, October 25, 2016

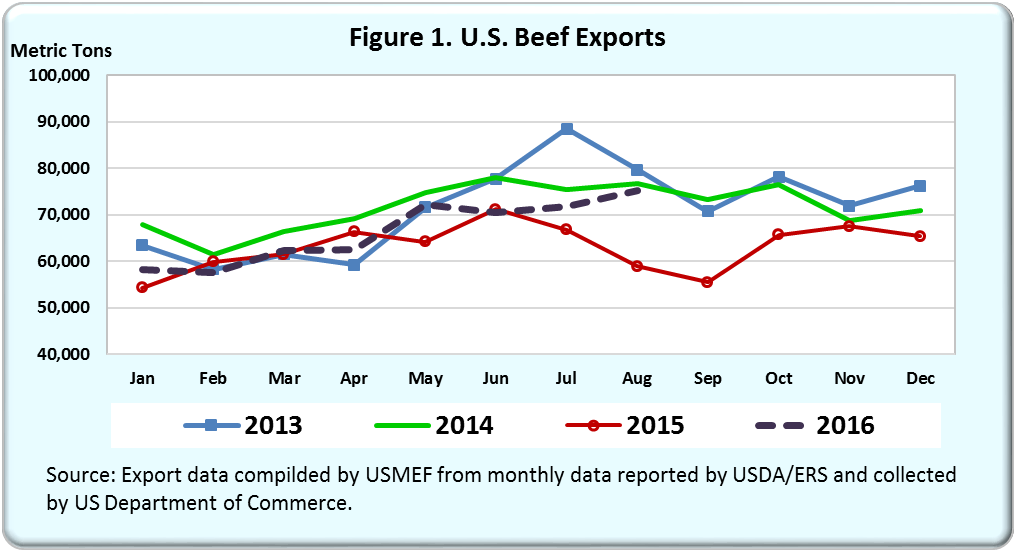

U.S. beef exports in August 2016 reached a volume of 75,236 metric tons (MT), increasing both year over year (27.6%) and relative to the previous month (4.9%) (see Figure 1). U.S. beef exports during August 2016 were valued at $480.990 million, up 11.5% and 5.5% relative to the same period last year and the previous month, respectively.

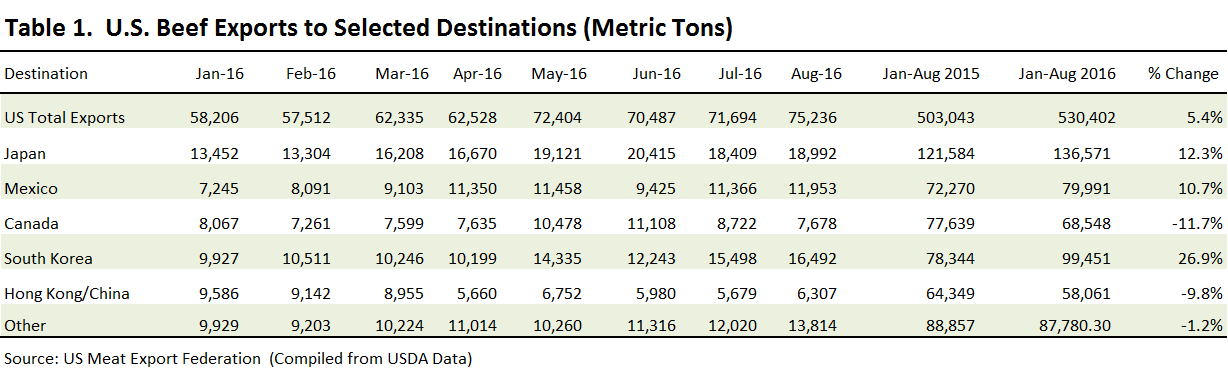

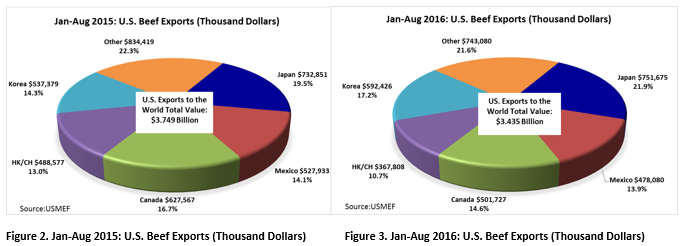

The volume of U.S. beef exported from January to August 2016 (530,402 MT) was up 5.4% compared with the same period in the previous year (see Table 1); nonetheless, mainly due to lower U.S. beef prices, the value of those exports ($3.435 billion) was down 9% compared with the same period last year ($3.749 billion). Prices have been consistently declining this year, particularly since the middle of June. Weekly choice beef cutout was quoted at $225.53/cwt during the week ending June 17, 2016 in contrast to $200.34/cwt, the quote during the week ending August 26, 2016, which represents an 11% decrease. As of the week ending October 7, 2016, choice beef cutout was quoted at $184.72/cwt, or 18% lower than in June 2016. Increasing beef production this year has put downward pressure on prices. According to the latest USDA’s forecast (World Agricultural Supply and Demand Estimates report [WASDE, October 12, 2016]), the 2016 U.S. beef production will increase 5.3% to 11.35 million MT relative to the previous year (10.78 million MT).

Japan is the leading volume and value market for U.S. beef this year, representing 25.7% of total volume of U.S. beef exports during the first eight months of 2016. Exports to Japan reached a volume of 18,992 MT in August 2016, rising 43.8% compared with the same period last year and 3.2% relative to exports during the previous month (see Table 1 above). As indicated by the U.S. Meat Export Federation (USMEF), strong growth for high-value chilled muscle cuts contributed to the good performance of U.S. beef exports to Japan. U.S. beef exports to Japan in August was valued at $106.7 million compared with $76.6 million during the same period last year. The total volume of U.S. beef exported to Japan during the first eight months of this year increased 12.3% to 136,571 MT year over year, as U.S. beef exports to Japan have continuously grown since February, reaching the highest volume in June (20,415 MT). Exports in July and August have declined since June, but have been above 18,400 MT each month. Total U.S. beef exports to Japan from January to August 2016 were valued at $751,675, up 2.6% year over year, and represented 21.9% of total export value during this period. (See Figures 2 and 3).

From January to August 2016, U.S. beef export volume to South Korea, the second largest market for U.S. beef muscle cuts this year, was 26.9% above last year (see Table 1), and the value of those exports rose 10.2% to $592.4 million from last year ($537.4 million) (see Figures 2 and 3). Based on USDA’s Livestock, Dairy, and Poultry Outlook report published on September 16, 2016, South Korea’s tight domestic supplies and high prices have contributed to the expanded import demand for U.S. beef through this year (2016). In addition, according to the USMEF, the increasing popularity of U.S. steaks, especially at the retail level, has supported U.S. beef export growth to South Korea, both in volume and value.

Exports to Mexico during August 2016 registered the highest volume of the year at 11,953 metric tons (see Table 1), increasing 32% from August 2015 and 5.2% from the previous month. U.S. beef exports to Mexico in August 2016 were valued at $68.3 million, up 2.4% from last year ($66.6 million) and 7.4% from last month ($63.6 million). The main beef cuts exported to Mexico in August were shoulder clods and rounds. Overall, 79,991 MT of U.S. beef have been exported to Mexico during the first eight months of 2016, increasing 10.7% from previous year’s volume, but declining in value by 9.4%, from $527.9 million in 2015 to $478.1 million in 2016 (see Figures 2, and 3). Low beef prices and exports of more economical beef cuts, are among the factors that contributed to lower value of U.S. exports to Mexico during this year. The value of U.S. beef exports to Mexico during the first eight months of 2015 and 2016 represented about 14% each of the total value of 2015 and 2016 U.S. beef exports.

U.S. beef exports to other important destinations such as Canada and Hong Kong/China have declined this year (2016). From January to August 2016, U.S. beef exports to Canada fell 11.7% in volume and 20.1% in value from a year ago; nonetheless the value of exports to Canada this year (January to August 2016) was 4.9% above the value of U.S. exports to Mexico (see Figure 3).

Meanwhile, Canada’s beef exports to Mexico are about to increase. According to the Canadian Meat Council (see here), the Agriculture and Agri-Food Minister Lawrence MacAulay announced on October 7, 2016, the conclusion of negotiations on new meat export certificates that will permit expanded trade with Mexico. This will allow access to the Mexican market for Canada beef products derived from animals 30 months and older, which were banned by Mexico in 2003 when Canada found its first domestic case of bovine spongiform encephalopathy (BSE). U.S. beef exports to Mexico, the third largest market for U.S. beef this year, may be negatively affected once Mexico fully resumes beef imports from Canada.

U.S. beef exports to Hong Kong/China during the first eight months of 2016 fell 9.8% to 58,061 MT compared with the same period last year (see Table 1). Likewise, the value of U.S. beef exports to Hong Kong/China so far this year (January to August 2016) declined 24.7% to $367.8 million compared with last year. Meanwhile, based on a Global Agricultural Information Network (GAIN, September 26, 2016) report published by USDA-FAS, on September 22, 2016, China’s Ministry of Agriculture (MOA) and General Administration of Quality Supervision, Inspection and Quarantine (AQSIQ) lifted the Chinese ban on U.S. beef exports. After the discovery of a case of BSE in December 2003, several countries, including China, banned beef imports from the U.S. The ban lifting includes both boneless and bone-in beef from cattle below 30 months of age. USDA indicated that in order to fully restore access for U.S. beef exports, both the U.S. government and the Chinese government must still negotiate an export protocol and conduct audits to verify the protocol (i.e., China will conduct audits in the U.S. to confirm exports protocols). Based on knowledge as of the date of the announcement, the GAIN report indicates that besides veterinary health requirements, it is expected the protocol will also include traceability requirements.

Based on the October 2016 WASDE report, the forecast of U.S. beef production for 2017 is up 3.6% from the estimate for 2016. This forecast is supported by large cattle supplies and higher carcass weights. The latest (October 2016) Livestock and Poultry: World Markets and Trade report published by USDA-FAS, indicates a positive outlook for U.S. beef exports in 2017 based on expected increased exports to South Korea, Japan, and Mexico. Expected Australia’s lower beef production as a rainy 2016 has improved drought-stricken pastures and encouraged producers to hold stock for breeding, which will stimulate demand for U.S. beef in Asian markets, allowing the U.S. to increase market share in the area. Fully restoring U.S. beef exports to China in 2017 will benefit U.S. beef producers as China, the fastest growing market for beef, is expected to import 950,000 MT of beef in 2017 from all sources. Despite the relative strength of the dollar, declining wholesale beef prices will boost the competitiveness of U.S. beef in foreign markets.

- beef

- exports