posted by S. Patricia Batres-Marquez on Friday, September 30, 2016

Distillers dried grains with solubles (DDGS) is the main co-product of corn ethanol produced in dry-mill plants. Since 2007, on average, 97.1% of total DDGS production has come from dry-mill ethanol facilities with the remaining 2.9% coming from beverage distilleries. For each bushel of corn (56 pounds) used to produce ethanol, about 17 pounds of distillers grains are manufactured, so the expansion of dry-mill corn-base ethanol production in the U.S. has brought a substantial increase in the supply of DDGS. In 2014/15 about 36 million metric tons (MMT) of DDGS were produced in U.S. dry-mill corn-based ethanol plants, with the largest proportion (about 72%) consumed by the U.S. domestic livestock and poultry sectors. Since the latest USDA estimate for 2015/16 corn use for ethanol and co-products is the same as in 2014/15 (5.2 billion bushels)[1], the estimate for the 2015/16 DDGS production stands at 36 MMT.

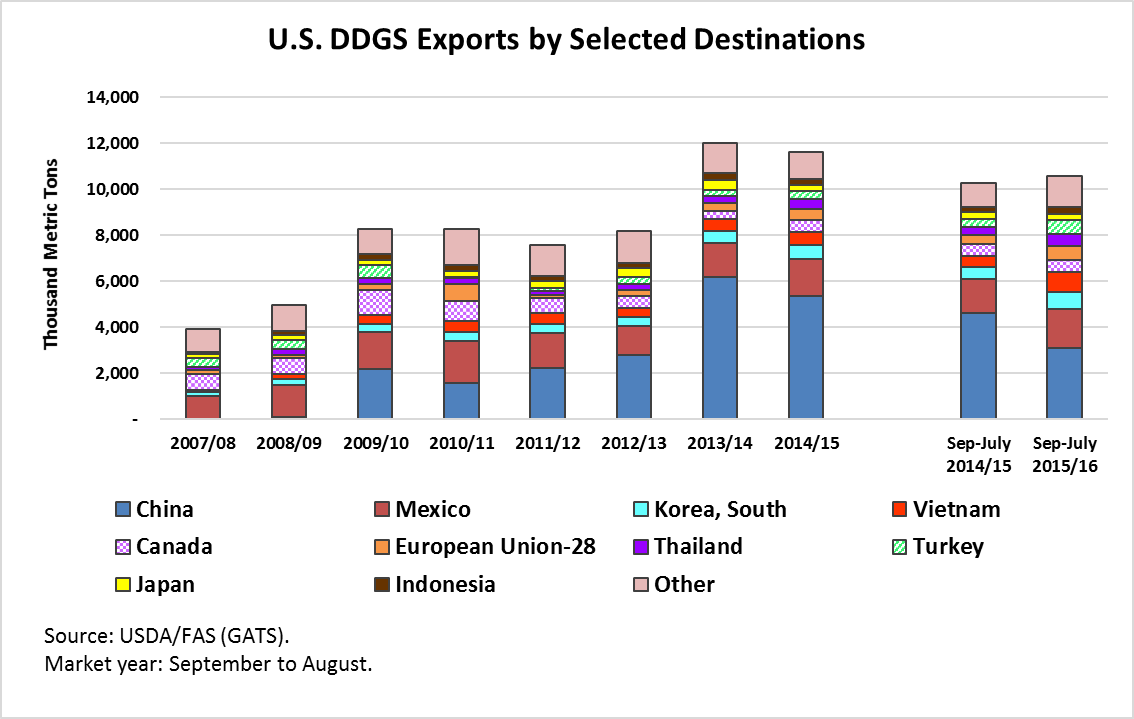

Besides being consumed by the U.S. domestic livestock and poultry sectors, DDGS is being shipped to foreign markets where demand for DDGS has been growing. As Figure 1 shows, the United States exported a total of 7.6 MMT of DDGS during the 2011/12 marketing year and in 2013/14 DDGS exports reached a record high volume of 12 MMT, increasing 58% from the 2011/12 level.

Behind the substantial increase in U.S. DDGS exports has been the growth of exports to China (see Figure 1). Before 2009/10, DDGS exports to China were below 0.1 MMT, but China’s increasing meat consumption and the transition from backyard livestock production to commercial livestock operations have contributed to the growth of China’s demand for DDGS for animal feed. DDGS exports to China increased from 2.2 MMT in 2009/10 to 6.2 MMT in 2013/14. Exports in 2013/14 represented 52% of total U.S. DDGS exports. So far this marketing year (September 2015 to July 2016), DDGS exports to China declined 33% to 3.1 MMT compared with the same period last year (4.6 MMT) (see Figure 1).

The share of exports to China during the first eleven months of the 2015/16 marketing year relative to total U.S. DDGS exports fell to 29% compared with 45%, the share of exports during the same period last year. An investigation by the Chinese Ministry of Commerce in response to petitions from Chinese DDGS producers for an antidumping and countervailing duty against DDGS coming from the U.S. has been dampening DDGS exports to China this marketing year. News reports indicate that as of September 23, 2016, China is imposing anti-dumping duties on U.S. DDGS, with the Ministry of Commerce announcing a 33.8% duty. Furthermore, other news reports announced that starting on September 30, 2016, China also will impose an anti-subsidy duty on imports of U.S. DDGS, ranging from 10% to 10.7%.

In addition, continued expansion of DDGS exports to China may be further challenged this year by China’s decision to end the floor price policy. This policy has been a price support policy for corn producers in China and has resulted in high corn stocks and suppressed domestic corn demand because of artificially elevated corn prices. In a Global Agricultural Information Network (GAIN) report (April 2016), the USDA indicated that elimination of the policy is inducing corn prices to decline, encouraging corn feed use in the second half of 2015/16. The report also indicated that imports of feed ingredients, such as sorghum, barley, and DDGS, will be the most immediate casualty of this policy change.

Despite the fall of exports to China during September 2015 to July 2016, total U.S. DDGS exports during this period rose 3%, to 10.6 MMT relative to the same period last year. Exports to Mexico, the second largest market for U.S. DDGS, increased 16%, to 1.7 MMT, during this period relative to the same period last year. Other than to China, Canada and Japan, exports to all other destinations rose. DDGS exports to Canada and Japan have so far declined this year relative to last year by 3% to 0.5 MMT and 6% to 0.3 MMT, respectively. Exports to Vietnam increased 82%, to 0.9 MMT, during this period and represented 8% of total U.S. DDGS exports from September 2015 to July 2016, making Vietnam the third largest market during this period. Data from USDA-FAS (Foreign Agricultural Service) indicates that the value of U.S. DDGS exports from September 2015 to July 2016 was $2.1 billion.

U.S. DDGS exports have managed to stay ahead of last year by increasing shipments to Mexico (the second largest market) and other markets. Although falling sales to the Chinese market is a cause for concern, continued expansion and diversification to other markets holds the key to the growth and stability of U.S. DDGS exports.

[1] The 2015/16 corn use for ethanol and co-products was reported in the September 12, 2016 World Agricultural Supply and Demand Estimates (WASDE) report. About 89.3% of corn used for ethanol and co-products is processed in dry-mill plants; the rest is processed in wet-mill plants.